BitAI Crypto Exchange Review 2025 - Risks, Fees, and Safer Alternatives

Oct, 6 2025

Oct, 6 2025

BitAI vs. Established Exchanges Risk Analyzer

High Risk - Lacks transparency, regulatory compliance, and verifiable performance data.

- Transparency Poor

- Regulation None

- Fees Vague

- Security Unknown

Low Risk - Transparent operations, strong regulation, and proven track records.

- Transparency Excellent

- Regulation Compliant

- Fees Clear

- Security Audited

Risk Assessment Result

Based on your selections, this platform is considered .

Quick Summary & Key Takeaways

- BitAI Method markets itself as an AI‑driven arbitrage platform, but verifiable data on performance, fees, and regulation is virtually nonexistent.

- Major red flags include missing company details, no audit reports, and no listing on reputable exchange rankings.

- Established exchanges such as Coinbase provide transparent fee schedules, KYC procedures, and audited trading data, making them far safer choices.

- If you still consider BitAI, treat it like a high‑risk experiment: start with a tiny amount, demand proof of trades, and be ready to withdraw instantly.

- For most traders, platforms like Kraken offer low fees, robust security, and regulatory compliance deliver better value and peace of mind.

What Is BitAI Method?

BitAI Method is presented as an automated cryptocurrency trading platform that claims to use artificial intelligence and algorithmic strategies to capture arbitrage profits. The promotional copy promises "unlocking the potential of arbitrage crypto" trading without requiring users to understand the underlying tech.

In practice, the platform provides a single dashboard where users deposit fiat or crypto, select a risk tier, and then watch a live profit counter. There is no public API documentation, no white‑paper, and no mention of a founding team or corporate registration. This lack of transparency makes it hard to verify whether the AI truly exists or if the profit numbers are fabricated.

How BitAI Says It Works

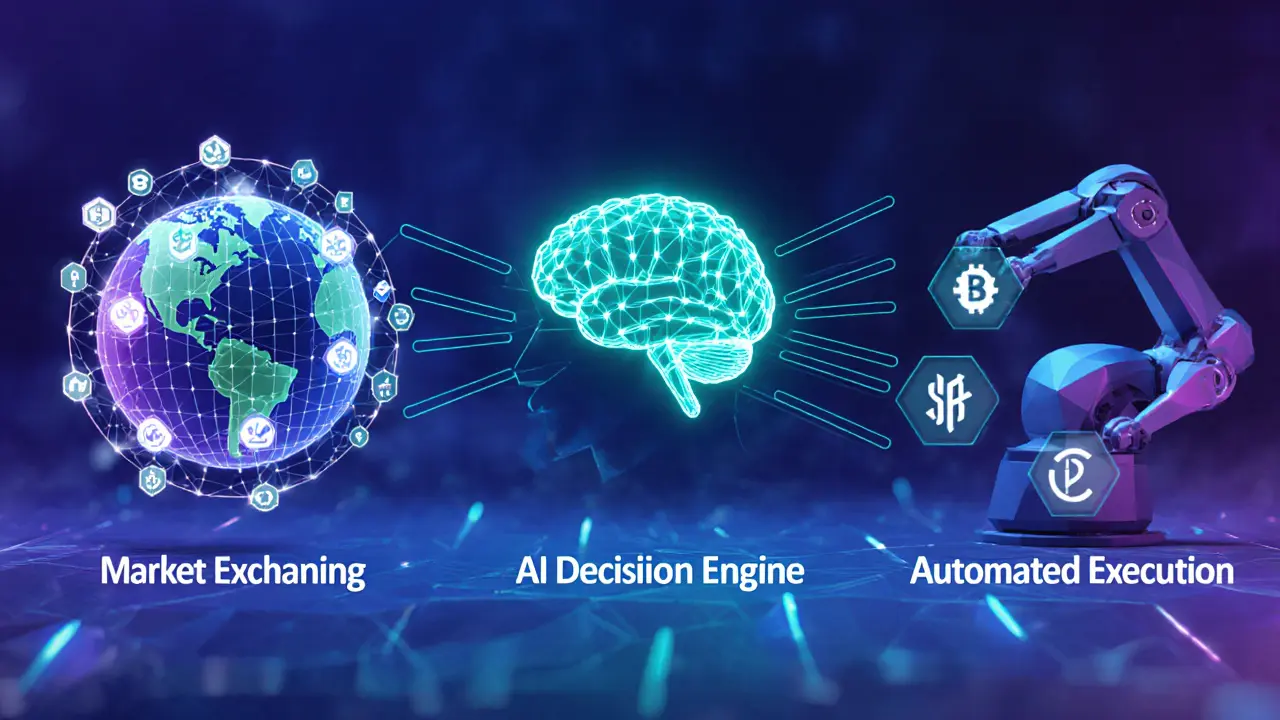

According to the website, BitAI runs three core modules:

- Market Scanning: Continuous monitoring of dozens of exchanges for price discrepancies.

- AI Decision Engine: Machine‑learning models decide when and where to execute arbitrage trades.

- Automated Execution: Smart contracts or internal bots perform the trade and immediately credit the user’s account.

The claimed advantage is speed - the system supposedly reacts in milliseconds, beating manual traders. However, no technical specifications (e.g., latency, server locations, model accuracy) are shared, and there are no third‑party audits to confirm the claims.

Red Flags & Legitimacy Concerns

When evaluating any crypto service, transparency is the first filter. BitAI fails on several fronts:

- No verifiable corporate info: A simple WHOIS lookup shows a privacy‑protected domain, and there is no registration number, address, or leadership team listed.

- Absent regulatory compliance: Unlike regulated platforms that display their licences (e.g., eToro operates under FCA, CySEC, and ASIC authorisations), BitAI provides no licence numbers or compliance statements.

- Missing fee schedule: Legitimate exchanges publish maker/taker fees, withdrawal costs, and any hidden charges. BitAI only mentions a vague "performance fee" that varies per user.

- No audited performance data: Reputable services release monthly trade reports or independent audit results. BitAI’s profit counters are the only metric shown, and they are not downloadable.

- Limited community presence: A search of Reddit, specialized forums, and major crypto news sites yields almost no genuine user discussions. Genuine platforms typically have active threads, AMAs, and community‑driven support.

These gaps line up with patterns identified by industry watchdogs for high‑risk trading schemes. The California DFPI’s crypto‑scam tracker, for instance, highlights platforms that promise unrealistic returns without verifiable proof - a description that matches BitAI’s marketing.

BitAI vs. Established Exchanges - A Quick Comparison

| Feature | BitAI Method | Coinbase | Kraken | Binance US |

|---|---|---|---|---|

| Supported assets | Not disclosed (claims "multiple cryptocurrencies") | 235coins & tokens | 350+coins & tokens | 158coins & tokens |

| Fee structure | Vague performance fee, no published rates | 0% - 3.99% (maker/taker) | 0% - 0.4% | 0% - 0.6% |

| Regulatory compliance | None publicly shown | NYDFS, FCA, EU AML | FinCEN, FCA, EU AML | FinCEN, state‑level licences |

| KYC/AML | Minimal info, optional | Identity verification required | Identity verification required | Identity verification required |

| Audit transparency | No third‑party audits published | Regular SOC 2 and independent audits | Annual SOC 2, crypto‑asset audits | Regular security audits, public reports |

| Community & support | Sparse, limited forum activity | 24/7 live chat, extensive knowledge base | Ticket system, live chat during business hours | Live chat, community forums |

The table makes it clear: where BitAI offers vague promises, the big exchanges back up every claim with data, licences, and user‑focused tools.

User Experiences & Community Voice

Because BitAI is not listed on major review aggregators, the only feedback comes from occasional blog posts and a handful of YouTube videos that showcase the platform’s UI. Those sources often focus on the profit counter and rarely mention withdrawal hurdles or support response times.

In contrast, platforms like Gemini maintains a public trust & safety blog and an active Reddit community have thousands of documented user experiences, both positive and negative. Those transparent ecosystems help traders learn from others, spot scams early, and get realistic expectations about fees and slippage.

Safety Checklist If You Still Want to Test BitAI

Should you decide to explore BitAI despite the warnings, follow this hardened due‑diligence list:

- Verify the domain owner: Use a WHOIS tool to see if the registrant is a known company or just a privacy shield.

- Ask for proof of trades: Request raw trade logs, timestamps, and blockchain transaction IDs. Match those IDs against public explorers.

- Check withdrawal limits: Test a small withdrawal first. Note processing time, fees, and whether the platform asks for additional KYC after you’ve already submitted documents.

- Secure your funds: Never store more than you can afford to lose. Keep the bulk of your crypto in a hardware wallet you control.

- Monitor regulatory alerts: Scan the DFPI, FCA, and ASIC warning lists regularly for any new notices about BitAI.

Even with these steps, the risk remains high because the platform’s core claims cannot be independently verified.

Safer Alternatives for AI‑Enhanced Trading

If AI‑driven strategies are what you’re after, several reputable services embed machine‑learning tools without compromising safety:

- Crypto.com: Offers a "Earn" product that algorithmically allocates funds across high‑yield pools, with clear APY disclosures.

- eToro CopyTrader: Lets you automatically replicate the trades of top performers; performance data is publicly visible.

- Binance Earn: Provides flexible and locked staking options powered by automated yield‑optimization engines.

All three are regulated, have audited financial statements, and maintain transparent fee tables - the exact opposite of what you see with BitAI.

Bottom Line

BitAI Method markets itself as a cutting‑edge AI arbitrage machine, yet the lack of verifiable data, missing regulatory footprints, and near‑nonexistent community make it a high‑risk proposition. Established exchanges such as Coinbase, Kraken, and Binance US set the industry benchmark for transparency, security, and user protection. For most traders, sticking with those platforms-or using a vetted AI‑enhanced product from a regulated provider-offers a far safer path to crypto investing.

Frequently Asked Questions

Is BitAI Method a real exchange or just a trading bot?

BitAI presents itself as a crypto trading platform, but it does not operate a traditional order‑book exchange. Without public APIs, a fee schedule, or regulatory licences, it functions more like a closed‑loop service that claims to run internal bots on your behalf.

Can I withdraw my money from BitAI at any time?

The platform mentions a withdrawal feature, but users report delays and additional KYC steps before funds are released. Testing a tiny withdrawal first is the only way to confirm the process.

What fees does BitAI charge?

BitAI does not publish a detailed fee schedule. It refers to a vague "performance fee" that varies per user, making it impossible to calculate exact costs before depositing.

Is BitAI regulated in any jurisdiction?

No regulatory licence information is available on the website. Legitimate exchanges typically display their licences prominently, which BitAI does not.

What are safer alternatives for AI‑driven crypto trading?

Consider regulated platforms like Crypto.com, eToro, or Binance Earn. They offer algorithmic yield products with clear terms and audited performance data.

Kimberly Kempken

October 6, 2025 AT 08:15BitAI is just a glorified Ponzi scheme wrapped in AI hype.

Eva Lee

October 11, 2025 AT 13:15When you dissect the architecture of BitAI, you encounter an opaque stack lacking any documented API endpoints, compliance attestations, or verifiable audit trails. The absence of a publicly disclosed fee matrix suggests a reliance on ambiguous performance fees, which is a hallmark of fiduciary opacity. Crypto‑trading platforms that boast proprietary machine‑learning usually provide white‑papers delineating model efficacy, yet BitAI offers no such technical exposition. Regulatory frameworks such as the NYDFS or FCA mandate clear KYC/AML procedures, but the platform’s onboarding process is optional at best. In essence, the operational footprint of BitAI mirrors that of a sandboxed black box, leaving users to gamble on unverifiable returns while forfeiting the safeguards standard in exchange ecosystems.

Carthach Ó Maonaigh

October 16, 2025 AT 18:15Look, the whole thing reeks of a scammy hustle – you deposit, you hope for a miracle, and the only thing you get is a vague “performance fee” that could be anywhere from 0 to the moon.

Brooklyn O'Neill

October 21, 2025 AT 23:15For anyone still considering BitAI, remember the fundamentals: verify corporate registration, demand transaction IDs, and never keep more than a small amount on an unverified platform. Community support and transparent reporting are essential for trust.

Greer Pitts

October 27, 2025 AT 03:15i totally get the hype but honestly if you cant see any audit reports just stay away. keep ya crypto safe on known exchanges.

Lurline Wiese

November 1, 2025 AT 08:15BitAI sounds like a drama‑filled nightmare.

Jenise Williams-Green

November 6, 2025 AT 13:15It is morally indefensible to promote a service that hides its fee structure and regulatory status; such obfuscation betrays the trust of unsuspecting investors.

Laurie Kathiari

November 11, 2025 AT 18:15The ethical red flag here is glaring: a platform that refuses to disclose basic compliance information is courting bad actors and endangering users.

Katherine Sparks

November 16, 2025 AT 23:15While the allure of AI‑driven returns is strong, one must remain vigilant and prioritize platforms with transparent governance and audited performance reports.

Ciaran Byrne

November 22, 2025 AT 04:15Short answer: avoid.

Jim Griffiths

November 27, 2025 AT 09:15Without a clear fee schedule, you can’t calculate net returns, which makes any promised profit purely speculative.

Matt Nguyen

December 2, 2025 AT 14:15The lack of a verifiable domain owner combined with privacy‑shielded registration hints at an intention to obscure accountability, a classic tactic in illicit financial services.

Cynthia Rice

December 7, 2025 AT 19:15In summary, the platform’s opacity, regulatory vacuum, and missing audits create a risk profile that eclipses any potential upside; diligence must outweigh desire.

Shaian Rawlins

December 13, 2025 AT 00:15Even if you’re tech‑savvy, the absence of any open‑source code or third‑party verification means you’re flying blind.

Tyrone Tubero

December 18, 2025 AT 05:15Blind faith in a black‑box system is the surest path to loss; demand transparency before you trust any algorithm.

Natalie Rawley

December 23, 2025 AT 10:15BitAI’s secretive nature screams “scam” to anyone who’s studied legit crypto services.

Scott McReynolds

December 28, 2025 AT 15:15From a philosophical standpoint, the allure of hidden AI promises reflects a deeper human desire for shortcut wealth, but reality demands evidence, not illusion.

Patrick MANCLIÈRE

January 2, 2026 AT 20:15Testing a micro‑deposit and monitoring the withdrawal timeline can reveal operational bottlenecks that larger users might never see.

Kortney Williams

January 8, 2026 AT 01:15Even if you manage a tiny test withdrawal, the lack of clear communication channels makes ongoing support doubtful.