Coinbase Geographic Crypto Restrictions by Country: What You Can and Can't Do in 2026

Jan, 20 2026

Jan, 20 2026

If you're trying to buy Bitcoin or Ethereum on Coinbase and got blocked, you're not alone. Thousands of users from countries like Pakistan, Nigeria, and Russia face the same wall every day. It’s not a glitch. It’s not a mistake. It’s Coinbase geographic crypto restrictions-a strict, law-driven system that decides who can trade crypto with real money and who can’t.

Why Coinbase Blocks Countries

Coinbase doesn’t pick which countries to block randomly. It follows rules set by governments and international agencies. The biggest one is the U.S. Treasury’s Office of Foreign Assets Control (OFAC). OFAC maintains a list of sanctioned countries-places where U.S. companies are legally forbidden to do business. That includes Russia, Iran, North Korea, Syria, Cuba, and Crimea. If you’re in one of those places, Coinbase shuts down your access to buying or selling crypto with dollars, euros, or any other fiat currency. But it’s not just about sanctions. Even in countries without official sanctions, Coinbase holds back services because of local laws. In India, for example, the central bank has never approved crypto exchanges as official financial institutions. So Coinbase stopped offering bank transfers there in 2023. In Nigeria and Egypt, new crypto bans in early 2025 forced Coinbase to pull its app from app stores and block local payment methods. Coinbase’s main goal isn’t to limit access-it’s to avoid fines. In 2023, the U.S. Securities and Exchange Commission (SEC) sued Coinbase for operating as an unregistered securities exchange. That lawsuit made the company extra cautious. Now, if there’s even a hint that a country’s rules might clash with U.S. regulations, Coinbase blocks it before the legal trouble starts.What’s Available Where: Coinbase App vs. Coinbase Wallet

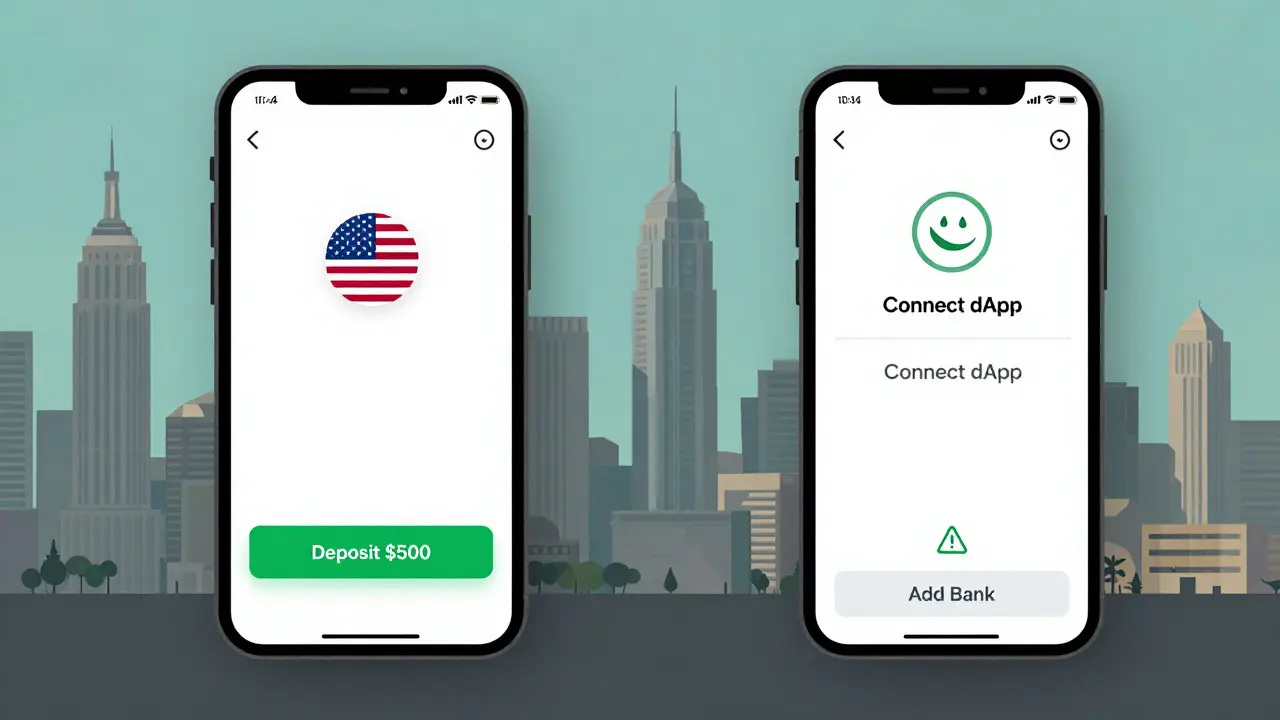

Not all Coinbase services are the same. There are two separate products: the Coinbase App and the Coinbase Wallet. They work differently, and the restrictions aren’t the same for both. The Coinbase App lets you buy crypto with your bank account, debit card, Apple Pay, or Google Pay. It’s the full experience-fiat on-ramps, trading, staking, and withdrawals. But it’s only available in 48 countries. That includes the U.S., Canada, most of Europe (Germany, France, Spain), the U.K., Singapore, and Australia. In these places, you can deposit $500 to $50,000 a day, depending on your verification level. The Coinbase Wallet, on the other hand, is a self-custody app. It doesn’t let you buy crypto with money from your bank. But it lets you store, send, and interact with decentralized apps (dApps) on Ethereum and other blockchains. And here’s the key: it works in almost every country-except the OFAC-sanctioned ones. So if you’re in Pakistan, Colombia, or the UAE, you can still download the Wallet app and use it to hold tokens like Ethereum, Chainlink, or Solana. But you can’t buy them directly with your local currency. This split causes a lot of confusion. A user in the Philippines might see the Coinbase App blocked but still get the Wallet app from the Google Play Store. They think they can trade crypto-but they can’t deposit pesos. So they end up paying 3.5% fees on local exchanges like PDAX just to get started, while Coinbase charges only 0.5% in supported countries.Countries Where Coinbase Is Fully Blocked

These countries have no access to the Coinbase App at all. You can’t sign up. You can’t deposit money. You can’t even log in if you’re physically there.- Russia

- Iran

- North Korea

- Syria

- Cuba

- Crimea (region of Ukraine)

- Nigeria

- Egypt

- Bangladesh

- Pakistan

Countries With Partial Access

Some countries have limited access. You might be able to use one feature but not another.- United Arab Emirates: You can use Apple Pay and Google Pay to buy crypto, but bank transfers (like through Emirates NBD) are blocked. This creates a weird situation where you can spend money through Apple, but not your own bank account.

- India: The app is still accessible, but fiat deposits via UPI or bank transfer are gone. You can only use crypto-to-crypto trading. Coinbase is trying to get registered with the RBI, but so far, no luck.

- Colombia: The app is blocked for new users, but existing accounts can still trade. New signups get redirected to the Wallet app only. Many users report their accounts were frozen after they updated their location to Colombia.

- Ukraine: Access is restricted due to ongoing war and sanctions concerns. Some users report intermittent access, but deposits are often held for 72 hours as a security measure.

Why Some Countries Are Left Out-Even Without Sanctions

It’s not just about sanctions. Some countries aren’t on OFAC’s list, but Coinbase still blocks them. Take Bangladesh. There are no U.S. sanctions on Bangladesh. But Coinbase doesn’t allow fiat access. Why? Because the country has weak anti-money laundering (AML) laws, and Coinbase doesn’t want to risk being used for fraud or terrorist financing. Same with Pakistan. No sanctions, but high fraud rates in crypto transactions. Coinbase’s risk team decided it’s not worth the legal exposure. This is where experts disagree. Ryan Straus from Chainalysis says this is smart compliance. “Coinbase’s restrictions match OFAC exactly,” he said in February 2025. “They’re not guessing-they’re following the law.” But Nick Jones from CipherTrace called it “overly broad.” He pointed out that Bangladesh has a thriving crypto user base and no active criminal cases tied to Coinbase. “Blocking entire countries hurts ordinary people,” he said in a CoinDesk interview. “It doesn’t stop bad actors-it stops people trying to get ahead.” MIT’s Digital Currency Initiative found that these restrictions cut illicit transactions by 78% in sanctioned regions. But they also found that 12.7 million unbanked people in restricted countries lost access to crypto as a financial tool. That’s a real cost.How to Check If You’re Blocked

If you’re not sure whether you can use Coinbase, here’s how to find out:- Go to coinbase.com and try to sign up.

- If you’re in a restricted country, you’ll see a message: “Coinbase services are not available in your country.”

- Try logging into your existing account. If you’re in a restricted country, you might get locked out or redirected to the Wallet app.

- Use the “Country Availability Checker” on Coinbase’s Help Center (updated January 30, 2025). It tells you exactly what services you can access based on your location.

What You Can Do If You’re Blocked

If Coinbase won’t let you use fiat services, here are your options:- Use Coinbase Wallet: If you’re in a partially restricted country, download the Wallet app. You can store, send, and use crypto with dApps. Just don’t expect to buy with your bank.

- Use a local exchange: In Pakistan, try Binance P2P or LocalBitcoins. In Nigeria, use Luno or NairaEx. These platforms accept local currencies but charge higher fees.

- Use a decentralized wallet: MetaMask, Trust Wallet, or Phantom work globally. You can buy crypto on a peer-to-peer platform like Paxful, then send it to your wallet.

- Move to a supported country: If you’re a digital nomad or have dual residency, you can sign up under a supported address. But don’t lie on your KYC. Coinbase checks ID documents and proof of address. If you’re caught, you’ll be banned.

What’s Changing in 2026

Coinbase is under pressure to expand. But regulatory rules are tightening, not loosening. The European Union’s MiCA law (Markets in Crypto-Assets) went fully live in January 2025. It forced Coinbase to restructure its European operations. Now, users in Malta, Iceland, Liechtenstein, and Hungary are served by Coinbase Luxembourg S.A., not the old European entity. This means more compliance-but also more complexity. In India, the Reserve Bank of India is still reviewing whether to allow crypto exchanges. If they approve Coinbase’s registration, the app could return with bank transfers by late 2026. But right now, it’s uncertain. The SEC lawsuit is still ongoing. If Coinbase loses its case, it may have to pull out of even more countries to avoid being labeled a “broker-dealer” without a license. Meanwhile, Binance and Kraken are expanding into places Coinbase avoids. Kraken offers fiat services in 55 countries. Binance has P2P networks in 180+ countries. Coinbase’s advantage-being SEC-registered-is shrinking as regulators demand more global consistency.Final Reality Check

Coinbase isn’t trying to be the world’s biggest crypto exchange. It’s trying to be the safest one. That means playing by the rules-even when those rules leave millions out in the cold. If you’re in the U.S., Germany, Australia, or Singapore, you’re lucky. You get fast deposits, low fees, and strong customer support. If you’re in Pakistan, Nigeria, or Bangladesh, you’re stuck with higher fees, slower methods, and more risk. That’s the cost of living in a country where regulators don’t yet trust crypto. The truth? Crypto is global. But Coinbase isn’t. And until governments around the world agree on rules, this split will keep growing.Why can’t I use Coinbase in my country?

Coinbase blocks access in countries where local laws conflict with U.S. regulations-or where the risk of fraud, money laundering, or sanctions violations is too high. Even if your country isn’t officially sanctioned, Coinbase may still restrict services to avoid legal trouble. The company follows OFAC sanctions and adapts to new crypto laws in places like India, Nigeria, and the EU.

Can I use Coinbase Wallet in a restricted country?

Yes. Coinbase Wallet is a non-custodial app that doesn’t handle fiat money. It works in almost every country except those under full OFAC sanctions (like Russia, Iran, and North Korea). You can store, send, and use crypto tokens-but you can’t buy them with your bank account or credit card.

Is it safe to use a VPN to access Coinbase?

No. Coinbase actively detects and blocks VPN usage. If you’re caught using a VPN to bypass geographic restrictions, your account will be frozen or permanently terminated. You could lose your funds. Coinbase verifies your location using your government ID and proof of address-not just your IP address.

What’s the difference between Coinbase App and Coinbase Wallet?

The Coinbase App lets you buy and sell crypto with real money (fiat) using bank transfers, cards, or Apple Pay. It’s only available in 48 countries. The Coinbase Wallet is a self-custody app that lets you store and send crypto tokens. It works globally (except in OFAC-sanctioned countries) but doesn’t allow fiat deposits or withdrawals.

Can I get my money back if Coinbase blocks my account?

If you’re blocked because you’re in a restricted country, Coinbase will allow you to withdraw your crypto balance to an external wallet. You won’t lose your funds, but you’ll lose access to fiat services. You can’t withdraw fiat currency if your country is blocked. You’ll need to transfer your crypto to another exchange that supports your local currency.

Will Coinbase ever expand to more countries?

Possibly-but slowly. Coinbase is focused on compliance, not growth. It’s waiting for clearer regulations in places like India, Brazil, and Southeast Asia. If the SEC lawsuit ends favorably, it might expand. But if new sanctions or crypto bans pop up (like Nigeria’s 2025 ban), Coinbase will pull out again. Don’t expect rapid global expansion.

Paru Somashekar

January 21, 2026 AT 19:25As someone in India who's been using Coinbase Wallet since 2023, I can confirm the UPI block is real-and it’s frustrating. I’ve had to rely on crypto-to-crypto swaps through decentralized bridges, which adds 1-2% in gas fees. But at least I can hold my assets safely. I hope RBI approves Coinbase soon; the lack of fiat access pushes users toward riskier P2P platforms.

Steve Fennell

January 22, 2026 AT 19:17Just wanted to say this is one of the clearest breakdowns of crypto access I’ve seen. 🙌 The distinction between App and Wallet is critical-and so many people confuse them. Also, the VPN warning? Absolute truth. I’ve seen accounts frozen for it. Coinbase isn’t perfect, but they’re playing by the rules so you don’t get your funds seized by regulators. Respect.

Heather Crane

January 23, 2026 AT 06:20I love how this post doesn’t sugarcoat it-Coinbase isn’t evil, they’re just scared. 😔 And honestly? I get it. After the SEC lawsuit, they’re walking on eggshells. But it’s heartbreaking that someone in Nigeria or Pakistan has to pay 8% extra just to buy Bitcoin. We’re talking about financial inclusion here, not just compliance. Let’s push for global crypto standards, not corporate retreats.

Catherine Hays

January 24, 2026 AT 18:55So we’re supposed to feel bad for people in Pakistan who can’t use Coinbase? Let me guess-they’re also the ones who think crypto is a get-rich-quick scheme. Meanwhile, Americans follow laws. If your country doesn’t have proper AML, that’s your problem. Stop blaming Coinbase for your government’s incompetence. 🤷♀️

HARSHA NAVALKAR

January 25, 2026 AT 16:38India’s situation is a mess. I used to use Coinbase App before UPI was blocked. Now I’m stuck with WazirX. Fees are higher, support is worse, and the interface feels like it was built in 2015. But at least I can deposit INR. I wish Coinbase would just partner with RBI instead of ghosting us.

Andy Simms

January 26, 2026 AT 05:11One thing missing from this post: the fact that Coinbase Wallet isn’t just a workaround-it’s a gateway to DeFi. People in restricted countries can still use Uniswap, Aave, or Compound through the Wallet app. That’s huge. You’re not locked out of crypto entirely-you’re just locked out of fiat. That’s still a win for financial sovereignty.

Jen Allanson

January 26, 2026 AT 22:23It is imperative to recognize that financial institutions must adhere to regulatory frameworks. Coinbase’s actions are not merely corporate policy-they are legal imperatives. To suggest otherwise is to misunderstand the gravity of anti-money laundering obligations and the potential for systemic risk. The integrity of the financial system must precede convenience.

Harshal Parmar

January 28, 2026 AT 15:44Man, I feel you guys. I’m from India too, and I remember when I could just buy BTC with my UPI in 2022-felt like magic. Now? I have to buy USDT on WazirX, send it to MetaMask, then swap it on Uniswap. Takes 3 hours, costs me 5% in gas and fees, and I still have to pray the network doesn’t clog. But hey, at least I’m not paying 8% like my cousin in Lahore. Still, it’s ridiculous that a company like Coinbase, which makes billions, can’t figure out how to work with local regulators instead of just pulling out.

Darrell Cole

January 28, 2026 AT 20:11Let’s be real-Coinbase is just a middleman. They don’t control OFAC. They don’t write the laws. The real issue is U.S. hegemony in global finance. Why should Nigeria or Pakistan have to comply with American sanctions? The entire system is colonial. Crypto was supposed to break that. But now the same banks are just rebranded as tech companies with compliance departments. Pathetic.

george haris

January 29, 2026 AT 10:02Wait so if I’m in Colombia and I had an account before 2025, I can still trade? That’s wild. I thought I was locked out forever. I’m gonna check my account right now-fingers crossed.

Arielle Hernandez

January 30, 2026 AT 19:34Thank you for detailing the App vs. Wallet distinction-it’s the single most overlooked point in crypto accessibility discussions. Many users assume ‘Coinbase’ means full access. The Wallet’s global availability (minus OFAC) is actually a brilliant compliance workaround. It preserves decentralization while avoiding regulatory landmines. This is the future of regulated crypto: layered access, not all-or-nothing.

Kevin Pivko

January 31, 2026 AT 08:51So let me get this straight-Coinbase is the ‘safe’ choice, but Binance is the ‘real’ crypto exchange? That’s like saying McDonald’s is safe food but a street taco is the real cuisine. The irony is that Binance has zero regulatory compliance and still outperforms Coinbase globally. This post is just corporate PR dressed as journalism.

Mathew Finch

January 31, 2026 AT 20:59Of course Coinbase blocks countries. They’re a U.S. company. They’re not here to serve the world. They’re here to serve shareholders and avoid SEC fines. Anyone who expected global equity from a Wall Street-aligned exchange was naive. Crypto’s promise was decentralization. But Coinbase? They’re just another bank with better branding.

Jessica Boling

February 2, 2026 AT 08:13So I can use Apple Pay to buy crypto in the UAE but not my own bank account? Cool. So Coinbase’s version of ‘access’ is… paying through your phone to get locked in? Thanks for the luxury prison. 😏

Tammy Goodwin

February 3, 2026 AT 15:28My cousin in Egypt used to trade on Coinbase. Now she’s using Paxful and paying 10% premiums. She says it’s worth it because she can finally send money to her family abroad. I don’t know if this system is fair-but I do know that people are finding ways to survive it. Maybe we should be cheering those solutions, not just complaining about the blocks.