HSM Key Management for Cryptocurrency Exchanges: The Essential Security Backbone

Dec, 15 2025

Dec, 15 2025

When a cryptocurrency exchange processes millions of trades every day, the biggest threat isn’t a hacker breaking through firewalls-it’s a single private key being stolen. And that’s where HSM key management becomes non-negotiable. Without it, exchanges are just digital vaults with broken locks. Every dollar of customer funds, every withdrawal request, every signature that moves crypto from one wallet to another relies on the integrity of those keys. If those keys are stored in software, on a server, or worse, on a developer’s laptop, the exchange is one breach away from disaster. That’s why every major exchange today uses Hardware Security Modules-physical devices built to keep private keys locked inside, never exposed, never copied, never leaked.

What Exactly Is an HSM?

A Hardware Security Module, or HSM, is a tamper-resistant physical device designed for one purpose: to generate, store, and use cryptographic keys without ever letting them leave its secure hardware boundary. Think of it like a digital safe with its own built-in lock, power supply, and alarm system. Unlike software-based key storage, where a hacker could potentially extract keys through malware or a memory dump, HSMs are engineered to destroy keys if someone tries to open them physically or probe them electronically. They’re certified to FIPS 140-2 Level 3 or Level 4 standards-meaning they can withstand environmental attacks like temperature extremes, voltage spikes, or even laser probes.

Modern HSMs don’t just store keys-they actively use them. When a user requests a withdrawal, the exchange’s system sends the transaction data to the HSM. The HSM signs it with the private key inside, then sends back only the signature. The private key never leaves. It never touches the internet. It never gets logged. It never gets backed up in plaintext. That’s the core principle: keys are never exposed, even to the systems that need them.

Why Exchanges Can’t Afford to Skip HSMs

The Mt. Gox collapse in 2014 wasn’t just a loss of 850,000 BTC-it was a wake-up call. That exchange stored keys in software, on regular servers, with no physical security. After the hack, the industry realized: if you’re holding customer funds, you need more than passwords and two-factor authentication. You need a hardware root of trust.

Today, 97 of the top 100 cryptocurrency exchanges by trading volume use HSMs for key management, according to CryptoCompare’s 2023 Security Report. The difference in security outcomes is stark. Exchanges using properly implemented HSMs with multi-party authorization score an average of 4.7 out of 5 for security. Those relying on software-only key storage? 2.1 out of 5. That’s not a small gap-it’s the difference between surviving a market crash and disappearing overnight.

Dr. Matthew D. Green from Johns Hopkins University put it bluntly: “Any exchange without FIPS 140-2 Level 3+ HSMs is operating with unacceptable risk.” Regulatory bodies agree. The New York Department of Financial Services now requires HSMs for all licensed virtual currency custodians. The European Central Bank is pushing similar rules for digital euro infrastructure. If you’re running an exchange, not using an HSM isn’t just risky-it’s becoming illegal in major markets.

How HSM Key Management Works: The Lifecycle

HSM key management isn’t a one-time setup. It’s a full lifecycle process, and every step matters.

- Key Generation: HSMs use hardware-based random number generators to create keys that are truly unpredictable. No software algorithm can match the entropy of physical noise.

- Key Storage: Keys are encrypted internally and never leave the HSM. Even backups are encrypted with other keys stored inside the same device.

- Key Deployment: Keys are activated only after strict authorization protocols are met-often requiring multiple operators to approve via physical tokens or biometrics.

- Key Rotation: Exchanges rotate keys every 30 to 90 days. This limits damage if a key is somehow compromised. The HSM handles this automatically, signing new keys and retiring old ones without downtime.

- Key Archiving and Disposal: Old keys aren’t just deleted-they’re cryptographically shredded. The HSM overwrites memory multiple times and logs the destruction event for audit purposes.

Some exchanges use a hybrid model: asymmetric keys (like RSA or ECDSA) for signing transactions are stored directly in the HSM. Symmetric keys (like AES) used to encrypt large volumes of data are generated by the HSM but stored encrypted elsewhere. This balances security with performance, since symmetric encryption is faster.

On-Premises vs. Cloud HSMs: The Trade-Offs

Exchanges have two main options: buy and install HSMs in their own data centers, or use cloud-based HSM services.

On-premises HSMs (like Thales Luna HSM 7) offer the highest performance-up to 20,000 RSA signatures per second-and the lowest latency (1-2 milliseconds per operation). That’s critical for high-frequency trading platforms that process over a million orders per second. But they cost $25,000+ per unit, plus 15-20% annual maintenance. You need physical security, power backups, and dedicated engineers to manage them.

Cloud HSMs (like AWS CloudHSM or Azure Dedicated HSM) are easier to scale and offer automatic geographic failover. During the 2021 European power outage, one exchange kept 99.95% uptime because their cloud HSMs replicated across regions. But they add 5-10 milliseconds of latency per transaction-enough to slow down a high-speed trading engine. They also cost $2.64/hour for AWS, or about $1,968/month for Azure. That adds up fast when you’re running multiple HSMs.

Most top exchanges now use a hybrid approach: on-premises HSMs for hot wallets (funds used for daily trading) and cloud HSMs for cold storage (long-term holdings). This gives them speed where they need it and resilience where they can afford a little delay.

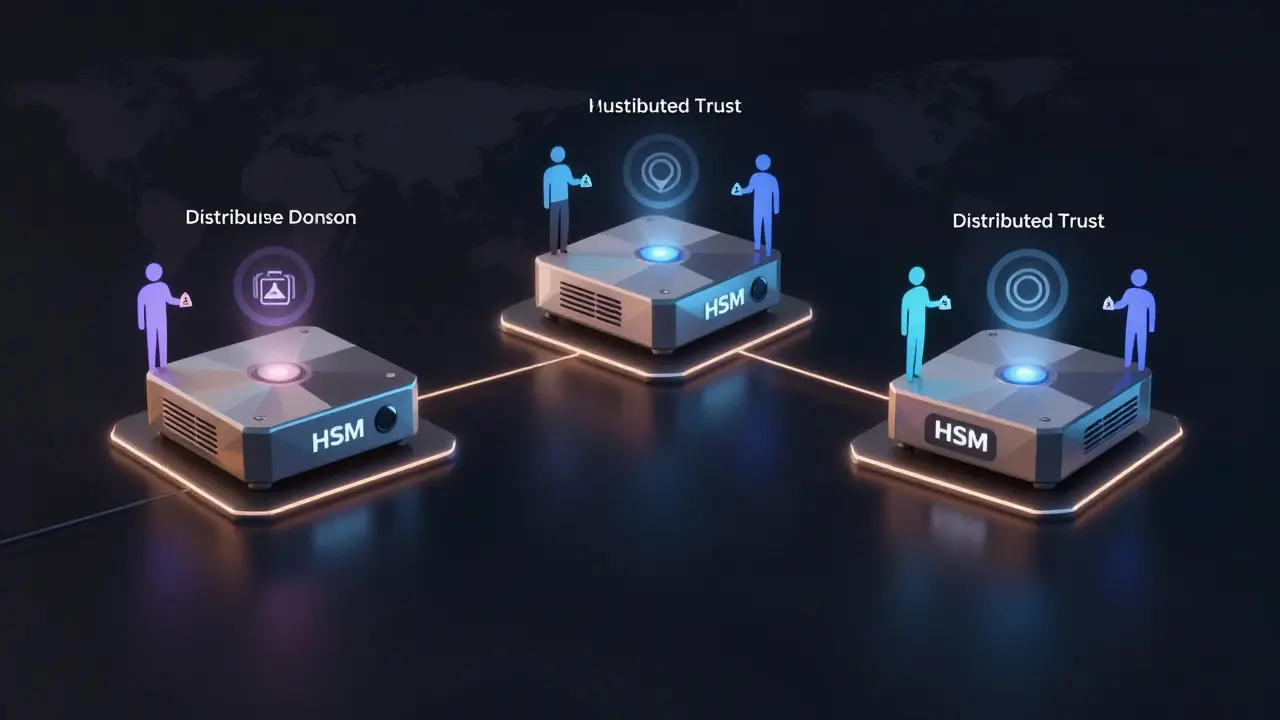

Multi-Party Authorization: The Real Game-Changer

Even the best HSM can be useless if one person can approve a withdrawal. That’s why exchanges now use Multi-Party Computation (MPC) integrated with HSMs. Instead of one key, you split the signing power across multiple HSMs, each held by a different team in a different location. To move funds, you need, say, 3 out of 5 approvals. One person can’t act alone. Even if one HSM is compromised, the attacker still can’t sign a transaction without the others.

Fireblocks’ 2023 report found that 78% of the top 50 exchanges now use MPC with HSMs. Kraken’s system, for example, requires 3-of-5 approvers, each with their own HSM in a different country. This is what saved them during the 2022 crypto winter-no single point of failure, no insider threat that could drain the vault.

What Can Go Wrong: Real Failures and Lessons

HSMs aren’t magic. They’re only as strong as the policies around them.

The QuadrigaCX collapse in 2019 wasn’t because their HSM was hacked. It was because they didn’t have one. They used a single hardware wallet, stored on a laptop, and when the founder died, no one had the access. $190 million vanished. No backup. No recovery. No audit trail.

Then there’s KuCoin in 2020. Their HSMs were properly configured, but attackers stole API keys from an employee’s compromised workstation. Those API keys could trigger withdrawals without needing the HSM to sign. The lesson? HSMs protect keys-but they don’t protect your entire system. You still need secure coding, access controls, and employee training.

Dr. Aggelos Kiayias warned at BlackHat 2023: “HSMs create a false sense of security if not integrated with full key lifecycle policies.” That’s the key takeaway. An HSM is a tool, not a solution. You need logging, monitoring, automated key rotation, multi-person approvals, and regular audits.

Getting Started: What You Need to Know

If you’re building or upgrading an exchange, here’s how to begin:

- Define your key lifecycle policy: Who generates keys? Who approves usage? How often are they rotated? Document every step.

- Choose your HSM type: On-premises for speed and control. Cloud for scalability and disaster recovery. Hybrid for balance.

- Ensure FIPS 140-2 Level 3 or 4 certification: Non-negotiable for compliance and security.

- Integrate with PKCS #11: This is the standard API most HSMs use. Your trading engine must speak this language.

- Implement MPC: Don’t rely on single-point approvals. Split authority across teams and locations.

- Test under load: Simulate peak trading hours. HSMs can bottleneck if you don’t batch requests properly. Coinbase had to build custom caching layers to handle 1.4 million orders per second.

Expect a 3-6 month implementation timeline. Thales’ own customer survey found 68% of exchanges needed 3+ months of engineering time just to get HSMs running smoothly. Don’t rush it. One misconfigured setting can leave your keys exposed.

The Future: Quantum Resistance and Beyond

By 2026, quantum computers may be powerful enough to break current encryption. That’s why Thales released Luna HSM 7.2 in early 2023 with support for CRYSTALS-Dilithium-a post-quantum cryptographic algorithm. The NSA already requires quantum-resistant HSMs for government systems as of 2024.

Looking ahead, HSMs will integrate with FIDO passkeys for withdrawal authorization, reducing phishing attacks by up to 92%. We’ll also see HSM-as-a-Service models grow, letting exchanges rent secure key management without buying hardware.

But the core won’t change: private keys must never leave secure hardware. As long as crypto exchanges hold real value, HSMs will remain the bedrock of trust.

FAQ

Do cryptocurrency exchanges really need HSMs?

Yes. Any exchange holding customer funds without an HSM is operating with unacceptable risk. HSMs are the only way to ensure private keys never exist in plaintext outside a tamper-proof device. Regulatory bodies like the New York DFS now require them. Exchanges without HSMs have been hacked, collapsed, or shut down.

What’s the difference between on-premises and cloud HSMs?

On-premises HSMs (like Thales Luna) offer higher performance (up to 20,000 signatures/sec) and lower latency (1-2ms), which is critical for fast trading. But they cost $25,000+ per unit and require physical security and dedicated staff. Cloud HSMs (like AWS CloudHSM) are easier to scale and offer automatic failover across regions, but add 5-10ms latency and cost $2.64/hour. Most exchanges use both: on-prem for hot wallets, cloud for cold storage.

Can HSMs be hacked?

HSMs themselves are extremely hard to hack physically-they’re designed to self-destruct if tampered with. But attackers often bypass them entirely by stealing API keys, compromising employee devices, or exploiting poor key management policies. The KuCoin hack in 2020 happened because an employee’s workstation was breached, not because the HSM was broken. HSMs protect keys, but not your entire system.

What is multi-party authorization (MPC) and why does it matter?

MPC splits the signing authority across multiple HSMs, each controlled by a different team in a different location. To move funds, you need, say, 3 out of 5 approvals. No single person or device can act alone. This eliminates the risk of insider threats or a single compromised key. 78% of top exchanges now use MPC with HSMs, and it’s become the industry standard for security.

How much does HSM key management cost?

On-premises HSMs cost $25,000+ per unit upfront, plus 15-20% annual maintenance. Cloud HSMs like AWS charge $2.64/hour, or about $1,968/month per instance. You’ll need multiple units for redundancy. Implementation and engineering support can add $100,000+ in labor costs over 3-6 months. But compared to losing $100 million like QuadrigaCX, it’s a small price.

Are HSMs future-proof against quantum computing?

Current HSMs use RSA and ECDSA, which quantum computers could break. But newer models like Thales Luna HSM 7.2 already support quantum-resistant algorithms like CRYSTALS-Dilithium. The NSA and NIST are pushing for adoption by 2026. If you’re investing in HSMs now, choose models that support post-quantum cryptography. They’ll still be secure for the next decade.

What standards should I look for in an HSM?

FIPS 140-2 Level 3 or Level 4 certification is mandatory for regulatory compliance and real security. Also ensure the HSM supports PKCS #11 v2.40 (the standard API), has hardware-based random number generation, and allows multi-party authorization. Avoid any device that doesn’t clearly list these specs.

Can I use open-source HSMs?

Open-source tools like OpenDNSSEC exist, but they’re not true HSMs-they’re software emulators. They don’t have tamper-proof hardware, so keys can be extracted. For any exchange handling real customer funds, open-source solutions are not secure enough. Stick with certified commercial HSMs from Thales, AWS, or Azure.

Patricia Amarante

December 17, 2025 AT 03:37Finally, someone gets it. I used to work at a crypto startup that tried to cut corners with software keys. We got lucky-no breach-but the fear? Real. HSMs aren’t optional. They’re the difference between sleeping at night or staring at your ceiling wondering if your code is the next Mt. Gox.

Just say no to laptop keys.

SeTSUnA Kevin

December 17, 2025 AT 06:48It’s not merely ‘important’-it’s a baseline. Any exchange lacking FIPS 140-2 Level 3+ HSMs is not merely negligent; it’s a regulatory liability masquerading as a financial institution. The fact that this even requires explanation speaks volumes about the current state of crypto governance.

Craig Nikonov

December 17, 2025 AT 23:04Oh sure, let’s trust a black box from Thales or AWS. Meanwhile, the NSA is quietly backdooring every HSM they certify. You think your keys are safe? Nah. They’re just encrypted… for them. The real hack isn’t the device-it’s the trust you put in the system.

And don’t even get me started on ‘cloud HSMs.’ That’s just someone else’s server with a fancy sticker.

Cheyenne Cotter

December 18, 2025 AT 07:04Look, I’ve read through this like three times and I still feel like I’m missing something. I get that HSMs are hardware that keep keys locked up, but why can’t we just use really good encryption on the server? Like, if the key never leaves the HSM, how does the system even know what to sign? Is there some kind of proxy? And what happens if the HSM breaks? Do you just lose all your crypto? Because that sounds terrifying. And also, I read somewhere that HSMs can be physically attacked with lasers? Like, actual lasers? Who even has lasers? Are we talking government-level stuff? Or could a really determined college kid with a $500 laser pointer crack one? I just need to know if my Binance holdings are actually safe or if I’m just deluding myself into thinking I’m not a fool for trusting them. I mean, I’ve seen people lose everything to phishing, but this feels like a whole other level of scary. And I’m not even mad, just… confused. And maybe a little paranoid now. Thanks for the info, I guess?

Sean Kerr

December 19, 2025 AT 04:51YESSSS!!! 😍👏 HSMs = NON-NEGOTIABLE!!! 💪🔥 I’ve been screaming this since 2021!!! My buddy lost 40k because his exchange used software keys-like, what even is that?? 😭💀 HSMs are the ONLY way!!! Don’t be that guy who says ‘I’m too poor for HSMs’-you’re too poor NOT to have them!!! 💸🔐 #HSMorBust #CryptoSecurityIsNotOptional

Rebecca Kotnik

December 20, 2025 AT 09:09While the technical merits of Hardware Security Modules are indisputable, one must also consider the sociopolitical implications of centralizing cryptographic authority within proprietary, vendor-controlled hardware. The very infrastructure that purports to secure decentralized finance remains, at its core, a centralized, proprietary, and often opaque system-raising questions about true decentralization. Are we building a more secure financial system, or merely replacing one form of institutional control with another? The answer may lie not in the technology itself, but in the governance models that surround it. Without transparency in key management policies, audit trails, and multi-party governance, even the most hardened HSM becomes a symbol of compliance rather than true security.

Terrance Alan

December 20, 2025 AT 23:12Everyone’s so obsessed with HSMs like they’re some kind of holy grail. But let’s be real-most of these exchanges are run by people who can’t even secure their own Slack passwords. You think a $25k box is going to stop an insider who’s been paid off? Or a dev who leaves an API key in a GitHub repo? The HSM’s not the problem. The people are. You can lock the vault, but if the guy with the key is already working for the thieves, you’re already dead.

And don’t even get me started on cloud HSMs. That’s just outsourcing your security to Amazon. Good luck getting your money back when AWS has an outage and your cold storage goes dark for a week.

Emma Sherwood

December 21, 2025 AT 21:56As someone who’s helped onboard smaller exchanges into compliance, I’ve seen firsthand how HSMs change lives-not just wallets. One founder told me, ‘I used to lie awake worrying about a hack. Now I sleep. Not because I’m naive, but because I know the system works.’ That’s the real win. It’s not just about crypto-it’s about trust. And trust, in this space, is the only currency that matters. If you’re building something that holds people’s money, you owe them more than a whitepaper. You owe them security that doesn’t rely on luck.

Chevy Guy

December 23, 2025 AT 21:12Oh so now we’re all supposed to believe that a $25k metal box is the answer to everything? Funny how the same people who scream ‘decentralize everything’ suddenly want to hand over their keys to Thales or AWS. Who’s auditing the auditors? Who’s watching the HSM vendors? And why do they all have the same government contracts? Coincidence? I think not.

Next thing you know, they’ll be putting GPS trackers in the HSMs so they know where your Bitcoin is at all times. Just sayin’.

Abby Daguindal

December 25, 2025 AT 05:26Anyone who still uses software keys deserves to lose everything. No sympathy. No second chances. This isn’t a debate. It’s a death sentence waiting to happen.

Donna Goines

December 25, 2025 AT 22:13Let’s be honest-HSMs are just the new version of the ‘trust the bank’ mentality. You think your keys are safe? What if the HSM vendor gets hacked? What if they’re forced to hand over the keys under some secret court order? What if the firmware gets updated and suddenly your keys are gone? It’s not security-it’s illusion. The real solution? Self-custody. Or nothing at all.

Florence Maail

December 26, 2025 AT 16:05Ugh I’m so tired of this ‘HSMs are the answer’ nonsense. Like, yeah sure, they’re fancy. But how many times have we seen ‘secure’ systems get wrecked because someone clicked a phishing link? HSMs don’t stop your admin from getting phished. They don’t stop your CFO from wiring money to a fake vendor. They’re just a shiny distraction so you don’t have to fix the real problem: people are dumb.

Also, who pays for all this? Me? My fees? 😒

Tom Joyner

December 27, 2025 AT 13:36Technically sound. But I find the entire premise uninteresting. The notion that institutional-grade hardware can solve a problem rooted in human behavior is naive. The market doesn’t need better locks-it needs fewer people with access to the vault.

Madhavi Shyam

December 29, 2025 AT 06:32PKCS#11 integration is mandatory. Without it, HSM interoperability fails. Also, ensure your HSM supports FIPS 140-3, not 140-2. NIST deprecated 140-2 in 2020. If you’re still using it, you’re already non-compliant.

Kayla Murphy

December 30, 2025 AT 06:46You got this! 💪 HSMs are scary at first but once you get them set up, it’s like having a bodyguard for your crypto. Every exchange should do it. You’re not just protecting money-you’re protecting people’s trust. And that’s worth every penny. Keep going!! 🚀

Dionne Wilkinson

December 30, 2025 AT 20:35It’s funny how we build these elaborate systems to protect digital keys, yet we still let people write passwords on sticky notes. Maybe the real issue isn’t the HSM-it’s that we still treat crypto like it’s magic. It’s math. It’s code. It’s not sacred. And we treat it like it is. Maybe we need less hardware and more humility.

Kelsey Stephens

January 1, 2026 AT 06:05I really appreciate how thorough this is. I’ve been trying to explain HSMs to my uncle who’s new to crypto, and I’ve been struggling. This is the clearest breakdown I’ve seen. Thank you for not just listing features but explaining why they matter. It’s easy to get lost in tech jargon, but you made it feel human. That’s rare.

Amy Copeland

January 2, 2026 AT 20:19Oh wow, a 20k signature/sec HSM? That’s so cute. Meanwhile, I’m running a node on a Raspberry Pi and I’m still more secure than 90% of these ‘enterprise’ exchanges. You know why? Because I don’t trust anyone. Not even the box.

Timothy Slazyk

January 3, 2026 AT 06:10Most people don’t realize that HSMs are only as good as their key rotation policy. I’ve seen exchanges with top-tier HSMs that rotated keys once a year-because ‘it’s expensive.’ That’s like having a vault with a deadbolt… and only changing the key every 12 months. The HSM isn’t the hero. The policy is. And if your policy is lazy, your security is a performance.

Samantha West

January 4, 2026 AT 04:56The entire HSM paradigm assumes a binary world: either the key is inside the box, or it’s not. But reality is more nuanced. What if the HSM’s firmware is compromised? What if the signing algorithm has a side-channel vulnerability? What if the random number generator is subtly biased? We treat HSMs as black boxes of divine infallibility-but they’re not. They’re silicon. They’re code. And code can be flawed. The real security lies not in the hardware, but in the diversity of systems, the redundancy of protocols, and the humility to admit that no single solution is perfect.

Greg Knapp

January 5, 2026 AT 05:21Everyone’s so hyped about HSMs like they’re magic. But you know what’s worse? When your exchange uses an HSM and then you find out they’ve got the backup keys on a USB stick in a drawer labeled ‘emergency.’ That’s not security. That’s theater. And I’m tired of being the audience.

Shruti Sinha

January 7, 2026 AT 04:25Good write-up. HSMs are necessary but not sufficient. The real risk is always the human layer. I’ve seen HSMs used correctly, but the dev team still used hardcoded keys in Docker configs. The box was perfect. The process? Not so much.

Heather Turnbow

January 9, 2026 AT 03:03While the technical depth here is commendable, I’m struck by the absence of any mention of ethical responsibility. When we outsource our cryptographic trust to corporate hardware vendors, we’re not just securing assets-we’re ceding control to entities whose primary obligation is to shareholders, not users. The HSM may protect the key, but who protects the user from the system that was built to protect it? That question remains unanswered.

Sally Valdez

January 9, 2026 AT 20:09USA says HSMs are mandatory. China says use their own crypto chips. EU says follow GDPR. So who’s really in charge? This isn’t security-it’s geopolitical control dressed up as tech. And we’re all just pawns in a game we didn’t sign up for.

George Cheetham

January 11, 2026 AT 19:14There’s something beautiful about this. We’re not just talking about hardware-we’re talking about the philosophy of trust. In a world where everything is digital, ephemeral, and easily copied, the HSM becomes a physical anchor. A reminder that some things must be rooted, protected, and sacred. It’s not just about crypto. It’s about what we choose to protect-and why.