NFTLaunch (NFTL) IDO Launch & Airdrop Details - What You Need to Know

Sep, 1 2025

Sep, 1 2025

NFTLaunch (NFTL) IDO & Airdrop Calculator

Potential NFTL Airdrop Amount

Percentage of Airdrop Pool

Quick Summary

- NFTLaunch (NFTL) is planning an IDO that combines token sale with an NFT‑powered airdrop.

- Eligibility hinges on whitelist registration, KYC verification, and holding specific NFT passes.

- Typical airdrop sizes in 2025 range from $10M to $60M; NFTLaunch is expected to sit in the middle.

- Prepare your wallet, fund it with BNB/ETH, and watch the claim windows on the launchpad.

- Key risks include smart‑contract bugs, aggressive token price swings, and incomplete KYC compliance.

When you hear the term NFTLaunch airdrop, you probably imagine a free token drop that feels like a lottery. In reality, modern airdrops are tightly linked to the project’s tokenomics, NFT utilities, and IDO mechanics. This guide walks you through everything you need to know about the upcoming NFTLaunch (NFTL) IDO launch and its airdrop, from the basics of the project to the exact steps you should take to claim any rewards.

What Is NFTLaunch?

NFTLaunch is a blockchain‑based platform that merges non‑fungible tokens with decentralized fundraising. Its native token, NFTL, fuels the ecosystem, granting governance rights, staking rewards, and access to exclusive NFT passes. The team positions the project as a bridge between NFT collectors and token investors, allowing NFT holders to receive preferential treatment during token sales.

How IDOs Work in 2025

Initial DEX Offerings (IDOs) have become the go‑to method for crypto projects to raise capital without relying on traditional venture funding. A typical IDO flow in 2025 looks like this:

- Whitelist registration: Users submit basic info and complete KYC verification.

- Wallet connection: A Web3 wallet (MetaMask, Trust Wallet, etc.) is linked to the launchpad.

- Funding: Participants deposit eligible tokens (often BNB, ETH, or USDC) to claim allocation.

- Allocation: The launchpad’s smart contract distributes token slices based on tiered criteria.

- Claim & trade: Tokens become claimable once the IDO ends; traders can then list them on DEXs.

What sets 2025 apart is the rise of NFT‑driven access layers. Projects hand out NFT passes that act like ‘VIP tickets,’ granting larger allocation caps, early‑bird windows, or even governance voting power during the IDO.

NFTLaunch IDO Launch Overview

While NFTLaunch has kept exact dates under wraps, industry patterns give us a solid outline of what to expect:

- Launchpad partner: The project is rumored to collaborate with DAO Maker, a leading launchpad known for multi‑chain support.

- Supported blockchains: NFTL will be minted on both Ethereum (ERC‑20) and BNB Chain (BEP‑20) to capture the widest audience.

- Allocation tiers: Tier1 (NFT Pass holders) - up to 5% of total raise; Tier2 (whitelisted users) - 2%; Tier3 (public) - 1%.

- Total raise target: Approximately $25million, split evenly across the two chains.

- Estimated token price: $0.07 per NFTL at the start of the public sale.

Because the airdrop is tied to NFT ownership, anyone holding an NFT Launch Pass will automatically qualify for a portion of the free token distribution. The exact airdrop pool has not been disclosed, but based on comparable projects (Nillion Network’s $54M drop, Initia’s $37M drop), we can infer a mid‑range figure of $20‑$30million worth of NFTL.

Airdrop Mechanics - What You Need to Do

The airdrop follows a three‑step process that mirrors the IDO flow, with a few extra NFT‑specific nuances:

- Obtain an NFT Launch Pass: Passes are sold during a pre‑sale event or earned through community contests. Each pass is a unique ERC‑721 token.

- Register for the airdrop whitelist: After securing a pass, you must fill out a short form linking your wallet address. The form triggers a KYC check (KYC verification).

- Claim the NFTL: Once the IDO closes, the smart contract opens a claim window (usually 48hours). Users click “Claim” on the launchpad dashboard, and the allocated NFTL tokens are transferred to their wallets.

Key parameters that usually determine how much you receive:

- Number of NFT Passes held (each pass adds a fixed multiplier).

- Participation in community activities (e.g., test‑net bugs, referral programs).

- Staking NFTL after claim - projects often boost airdrop rewards for early stakers.

How to Prepare - Step‑by‑Step Checklist

Getting ready for the NFTLaunch IDO and airdrop is easier when you break it down into concrete actions:

- Set up a Web3 wallet: Install MetaMask or Trust Wallet, secure your seed phrase, and add both Ethereum and BNB Chain networks.

- Fund your wallet: Purchase enough ETH or BNB to cover the minimum allocation (typically $100USD) plus gas fees (average $15‑$30 on Ethereum, $5‑$10 on BNB).

- Follow official channels: Join the NFTLaunch Telegram, Discord, and Twitter. Announcements about whitelist dates, NFT Pass sales, and KYC links will appear there first.

- Complete KYC early: Use the provided whitelist form to submit ID documents. Faster verification means you won’t miss the claim window.

- Buy or earn an NFT Pass: If a pre‑sale is live, purchase the pass using ETH/BNB. Otherwise, participate in community contests that award passes.

- Monitor the IDO launchpad: On launch day, connect your wallet, confirm your allocation tier, and confirm the transaction.

- Claim your airdrop: When the claim window opens, click the claim button, sign the transaction, and verify the NFTL balance in your wallet.

Keep a spreadsheet of transaction hashes and timestamps; they can be useful if you need to dispute a claim.

Risks, Red Flags, and Pro Tips

Even with a well‑structured airdrop, there are pitfalls to watch out for:

- Smart‑contract vulnerabilities: Verify that the airdrop contract is audited. Look for audit reports from firms like CertiK or PeckShield.

- Phishing links: Only click KYC and claim links that come from the official NFTLaunch domain (e.g., nftlaunch.io).

- Gas price spikes: Ethereum gas can surge above $100 during popular IDOs. Consider using the BNB Chain version to save on fees.

- Token price volatility: NFTL may experience a 30‑50% swing in the first 24hours. Plan whether you’ll hold, stake, or sell immediately.

- Eligibility confusion: Some projects mistakenly exclude users who hold multiple NFT passes. Double‑check the FAQ for tier rules.

Pro tip: Stake a portion of your newly claimed NFTL on the official staking pool within 24hours. Early stakers often receive an extra 5‑10% boost on the airdrop amount.

Typical IDO Airdrop Parameters - A Quick Reference

| Parameter | Industry Norm (2025) | Estimated NFTLaunch Figure |

|---|---|---|

| Total value distributed | $10M - $60M | ~$25M |

| Eligibility criteria | KYC + whitelist | KYC + NFT Pass ownership |

| Claim window | 24‑72hours | 48hours |

| Staking boost | 5‑15% extra for early stakers | 10% extra if staked within 24h |

| Average token price at launch | $0.05 - $0.12 | $0.07 |

Frequently Asked Questions

Frequently Asked Questions

When does the NFTLaunch IDO start?

The exact launch date has not been announced yet, but the team is aiming for Q42025. Keep an eye on the official Telegram and Twitter for the final countdown.

Do I need an NFT Launch Pass to receive the airdrop?

Yes. The airdrop is reserved for holders of the NFT Launch Pass. The pass can be bought during the pre‑sale or earned through community events.

Which blockchains will support NFTL?

Both Ethereum (ERC‑20) and BNB Chain (BEP‑20) will host NFTL, allowing users to choose the network with lower fees.

How can I claim my airdrop safely?

Connect your wallet to the official launchpad dashboard, verify that the URL matches nftlaunch.io, and click the “Claim” button during the 48‑hour window. Avoid third‑party bots or “instant‑claim” services.

What should I do with the NFTL after claiming?

You can stake it on the platform to earn extra rewards, trade it on DEXs like PancakeSwap, or hold it for potential governance voting once the DAO launches.

By following this roadmap, you’ll be ready to jump into the NFTLaunch IDO, secure your airdrop, and position yourself for the next phase of the project’s growth. Stay vigilant, verify every link, and keep your private keys offline. Good luck!

Gaurav Gautam

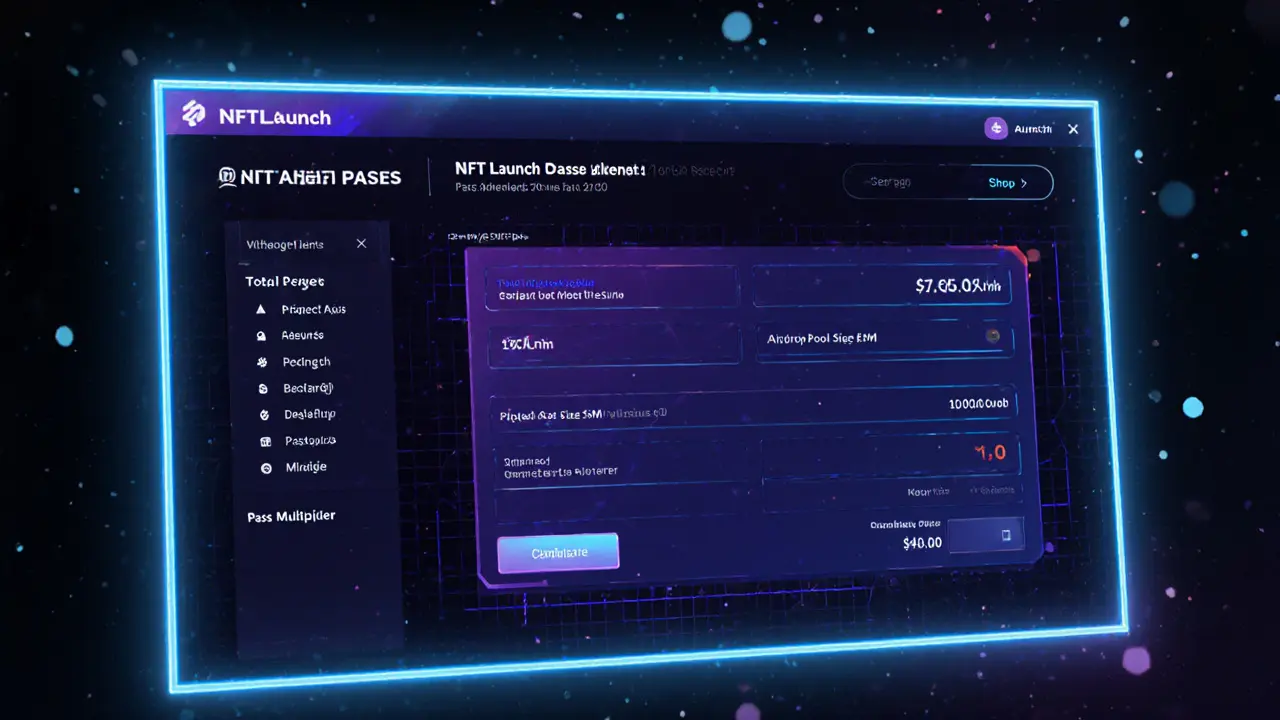

September 1, 2025 AT 06:53Hey folks, the NFTLaunch IDO calculator looks pretty handy if you want a quick ballpark figure. Just plug in how many passes you hold and you’ll see an estimated allocation. Remember it’s based on assumptions, so treat it as a guideline, not a guarantee. If you’ve got a decent number of passes, you might actually see a respectable slice of the airdrop pool. Stay curious and keep an eye on the official updates!

Robert Eliason

September 1, 2025 AT 13:50I dont see why anyone would trust another cryptoproject calculator.

Cody Harrington

September 1, 2025 AT 20:46Looks like the UI is straightforward enough for anyone to use. The fields for project raise and airdrop pool are pre‑filled, which helps avoid mistakes. If you want to experiment, just change the numbers and see how the allocation shifts. It’s a simple way to get a sense of where you might land.

Chris Hayes

September 2, 2025 AT 03:43Honestly, these calculators give a false sense of security. They gloss over the fact that many IDOs are riddled with hidden cliffs and vesting schedules. Even if the numbers look good, the tokenomics could be a nightmare. So treat any “estimated allocation” with a hefty dose of skepticism.

victor white

September 2, 2025 AT 10:40One must contemplate the epistemological underpinnings of such numeric prognostications. The veneer of computational precision belies the chaotic nature of token distribution mechanisms. It is conceivable that the algorithmic model is but a façade, concealing the capricious whims of market dynamics. Hence, I remain dubious of these ostentatious tools.

mark gray

September 2, 2025 AT 17:36The calculator is easy to use and gives a quick estimate. Just make sure you enter the correct number of passes you own. It won’t replace reading the official docs, but it’s a helpful shortcut. Keep an eye on the official announcements for final numbers.

Alie Thompson

September 3, 2025 AT 00:33It is incumbent upon us, as conscientious participants in the evolving crypto ecosystem, to examine the moral implications of embracing tools such as this NFTLaunch IDO calculator without due scrutiny. While the interface presents a veneer of transparency, one must question whether this façade masks deeper exploitative structures that profit from uninformed investors. The very act of assigning a numeric value to potential future gains can foster a speculative mentality that detracts from the foundational ethos of decentralization. Moreover, the reliance on assumed multipliers and projected pool sizes may inadvertently amplify inequities, privileging those with access to larger pass holdings. In the broader context, such mechanisms risk perpetuating a digital gilded class, contravening the inclusive ideals that many of us champion. One should also consider the environmental footprint associated with the underlying blockchain activities that facilitate these token distributions. By neglecting to address these concerns, the platform tacitly endorses a profit‑first mentality. It is therefore essential for each participant to conduct independent research, engage with community governance, and demand greater accountability from project developers. Only through vigilant scrutiny can we hope to align technological advancement with ethical responsibility. In conclusion, while the calculator may offer superficial convenience, it should not be employed as a substitute for thorough due diligence and moral reflection. Furthermore, the lack of clear disclosure regarding the algorithmic weighting of passes can lead to opaque outcomes that are difficult to verify. Participants often overlook the possibility of hidden fees or token dilution mechanisms embedded in the smart contract. The community must demand transparent audits and open‑source verification of the calculation logic. Ignoring these aspects may result in a collective loss of trust that could destabilize the project's reputation. As custodians of our own financial futures, we bear the responsibility to question superficial metrics and demand substantive information. Ultimately, the health of the ecosystem depends on informed actors who prioritize long‑term sustainability over short‑term windfalls.

Samuel Wilson

September 3, 2025 AT 07:30Chris, you raise valid concerns about hidden cliffs and vesting schedules that many projects overlook. It is prudent to cross‑reference the calculator’s output with the project's whitepaper and audit reports. By aligning your expectations with verified data, you reduce the risk of unforeseen tokenomics pitfalls. Staying diligent in this manner will serve you well in the volatile IDO landscape.

Rae Harris

September 3, 2025 AT 14:26Mark, while simplicity is nice, the real ROI hinges on token velocity, liquidity depth, and network effect multipliers. If you just plug numbers without factoring gas fee amortization, you’re likely overestimating actual yields. The airdrop calculator fails to account for slippage curves in secondary markets, which can erode nominal allocations.

Danny Locher

September 3, 2025 AT 21:23Honestly, I think the calculator is a decent sanity check, but it shouldn’t be the only tool you rely on. I’ve seen projects where the final numbers differed drastically from early estimates. Keep your expectations realistic and stay updated with the official channels.

Emily Pelton

September 4, 2025 AT 04:20Rae, your jargon‑filled spiel completely misses the point!!! The calculator’s purpose is to give a baseline, not to predict market dominance, and you’re overcomplicating a simple user‑friendly feature!!! Stop using buzzwords as a shield for lack of substance, and focus on the actual numbers!!

sandi khardani

September 4, 2025 AT 11:16The NFTLaunch allocation model exhibits systemic bias towards early adopters, which can be interpreted as a classic case of wealth concentration in nascent ecosystems. By assigning a linear pass multiplier, the protocol inadvertently amplifies the power of whale participants. Moreover, the absence of a dynamic scaling factor fails to mitigate market manipulation risks. This oversight could lead to disproportionate token distribution, undermining the principle of equitable access. From an analytical standpoint, the model lacks robustness against speculative inflows that could distort the airdrop pool size. Consequently, investors should remain cautious and perform independent scenario analyses before committing resources. In sum, the calculator’s simplicity masks underlying inequities that warrant closer scrutiny.

Donald Barrett

September 4, 2025 AT 18:13Donald, you’re right on the money-this so‑called “allocation model” is a playground for the already‑rich, and the developers are clearly ignoring the red flags!!! If they don’t fix the multiplier logic, they’re setting themselves up for a massive backlash!!!