Slingshot Finance Crypto Exchange Review: Zero Fees, Cross-Chain Trades, and What It Really Offers

Feb, 13 2026

Feb, 13 2026

When you hear "crypto exchange," you probably think of Binance, Coinbase, or Kraken - platforms where you deposit money, they hold your keys, and you trade tokens with a small fee tacked on. But what if you could trade hundreds of thousands of tokens across multiple blockchains - with zero trading fees - and still keep full control of your funds? That’s Slingshot Finance. And it’s not another centralized hub. It’s a decentralized exchange built for people who want to skip the middleman, avoid fees, and move crypto between chains without juggling five different wallets.

Slingshot Finance launched as a response to the chaos of 2022, when centralized exchanges like FTX collapsed and users lost millions because they trusted someone else with their keys. The founders didn’t build Slingshot to compete with those giants. They built it to bypass them entirely. And now, after being acquired by Magic Eden - the biggest NFT marketplace on Solana - Slingshot is getting a serious upgrade. But is it still the right choice for you in 2026?

How Slingshot Finance Actually Works

Slingshot isn’t a traditional exchange. It doesn’t hold your crypto. It doesn’t even have a wallet of its own. Instead, it acts as a smart router for your trades. When you want to swap ETH for SOL, Slingshot scans dozens of decentralized exchanges - like Uniswap, PancakeSwap, and Curve - finds the best price, and executes the trade directly from your wallet. You sign the transaction. Your funds never leave your control. And because it’s all on-chain, there’s no KYC, no account, no login.

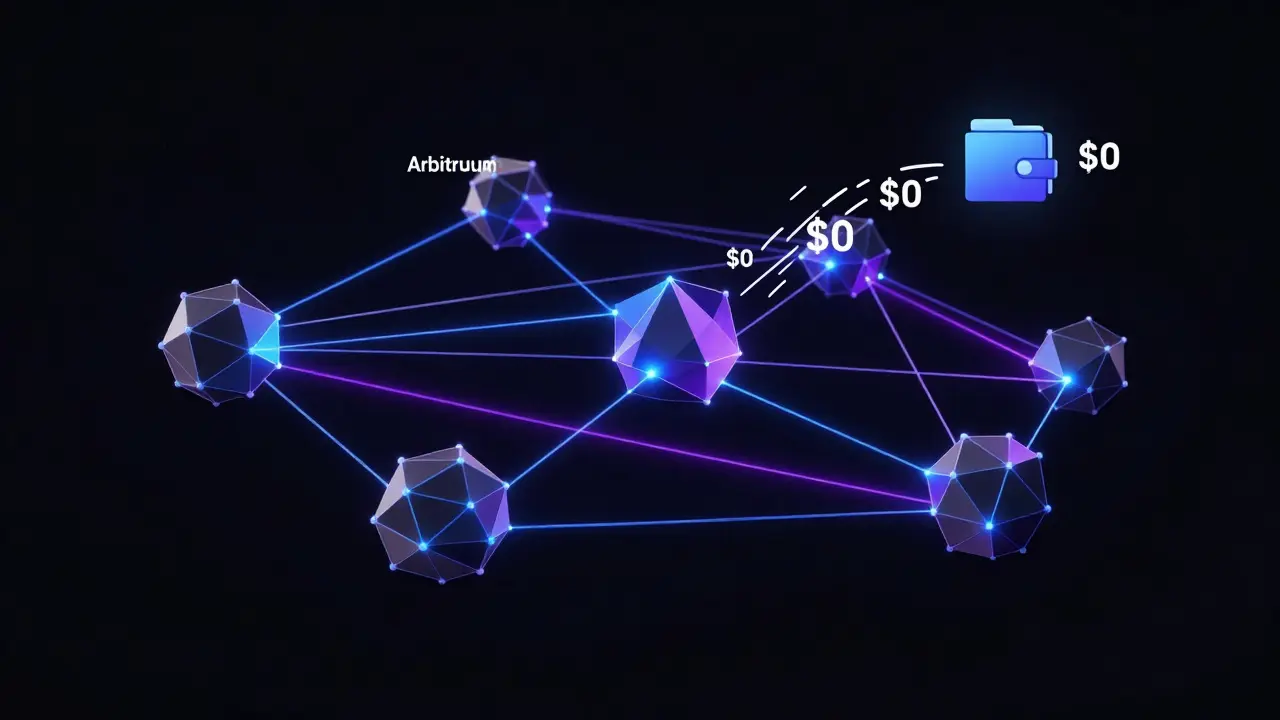

The real magic? Slingshot connects chains. You can start with USDC on Polygon, swap it for Arbitrum’s native token, then send it to Binance Smart Chain - all in one click. Most DEXs are locked to one blockchain. Slingshot moves across them. That’s why it supports over 40,000 tokens, including obscure memecoins, DeFi governance tokens, and even wrapped versions of Bitcoin and Ethereum.

And yes - there are zero maker and taker fees. Not 0.1%. Not 0.05%. Zero. That’s unheard of. Even Uniswap charges gas fees, and other aggregators like 1inch take a small cut. Slingshot covers those costs by partnering with liquidity providers and earning from protocol incentives. It’s not a scam - it’s a business model built on ecosystem growth, not user fees.

Who Is Slingshot Finance For?

Slingshot isn’t for everyone. If you’re new to crypto and still using Coinbase to buy Bitcoin with a credit card, this isn’t your first stop. You’ll need a Web3 wallet like MetaMask or Trust Wallet. You’ll need to understand gas fees. You’ll need to know how to switch networks in your wallet. Slingshot assumes you’ve already done that.

But if you’re an active trader who:

- Swaps between Arbitrum, Polygon, and BSC daily

- Gets frustrated by slippage and high fees on Uniswap

- Wants to avoid centralized exchanges after FTX

- Values privacy and self-custody

…then Slingshot is one of the few tools that actually makes sense.

It’s also perfect for NFT collectors. Magic Eden’s acquisition means Slingshot is likely integrating NFT trading features soon. Imagine buying an NFT on Solana, instantly swapping a portion of it for ETH on Ethereum, and using that ETH to pay for gas on another chain - all without leaving the platform.

Performance and Traffic: Is Anyone Even Using It?

Here’s the hard truth: Slingshot isn’t popular yet. As of late 2025, it gets around 1,820 monthly visits. That’s less than 0.3% of Uniswap’s traffic. It ranks 440th out of 600 crypto exchanges in web traffic. Most users come from organic search - not ads or social media.

But numbers don’t tell the whole story. Slingshot’s user base is small but intense. Its Twitter account had 70,000 followers by the end of 2022, and active users report it as the “fastest cross-chain trading app” on the Apple App Store. The bounce rate is only 29%, meaning people stick around. The average visit lasts almost four minutes - longer than most DeFi platforms.

That’s because Slingshot isn’t trying to be the biggest. It’s trying to be the best for a specific group: cross-chain traders who hate fees and trust no one.

The Magic Eden Effect

The biggest shift happened in early 2024, when Magic Eden - the company behind Solana’s largest NFT marketplace - bought Slingshot Finance. Magic Eden didn’t just invest. It absorbed the team, the tech, and the vision. That’s huge.

Before the acquisition, Slingshot was a scrappy startup with a great idea but limited resources. Now, it has access to Magic Eden’s engineering team, customer support infrastructure, and a user base of millions of NFT traders. The mobile wallet app - in development since late 2022 - is finally getting real attention. Updates in 2025 improved performance, added wallet integration, and streamlined the fiat on-ramp process.

Expect more soon: NFT trading, staking rewards, and possibly even a native token. Magic Eden’s move signals that Slingshot isn’t going anywhere. It’s becoming part of a larger DeFi ecosystem.

Pros and Cons: The Real Trade-Offs

Let’s cut through the hype. Here’s what Slingshot Finance does well - and where it falls short.

| Feature | Slingshot Finance | Uniswap | Coinbase |

|---|---|---|---|

| Trading Fees | 0.00% | 0.3% + gas | 0.5% - 1.5% |

| Custody Model | Non-custodial | Non-custodial | Custodial |

| Supported Chains | Arbitrum, Polygon, BSC | Ethereum only | 5 major chains |

| Token Selection | 40,000+ | 10,000+ | 200+ |

| Mobile App | In development | Yes | Yes |

| Regulatory Status | Unregulated | Unregulated | Regulated (US, EU) |

| Best For | Low-cost cross-chain swaps | Ethereum-only traders | Beginners, fiat deposits |

Pros:

- Zero trading fees - no exceptions

- True non-custodial control - your keys, your crypto

- Best-in-class cross-chain swaps

- High token variety - even obscure tokens

- Backed by Magic Eden - long-term stability likely

Cons:

- No fiat on-ramps yet - you need crypto already

- No margin trading, limit orders, or advanced tools

- Not regulated - risky if you live in the US, EU, or Australia

- Small user base - lower liquidity for some tokens

- Mobile app still in beta - web-only for now

Is Slingshot Safe?

Slingshot doesn’t have a license. It doesn’t follow AML rules. It doesn’t report to regulators. That’s not a bug - it’s a feature. But it’s also a risk.

If you’re in Australia, the US, or the EU, using Slingshot could violate local laws. The SEC has fined unregistered exchanges. The EU’s MiCA framework will crack down hard on non-compliant platforms. Slingshot doesn’t care - and that’s why some users love it.

From a technical standpoint, it’s safe. Contracts have been audited. Transactions are on-chain. No one can freeze your account. But if you lose your private key? No customer support will help you. No bank will reverse the transaction. You’re on your own.

How to Get Started

Here’s how to use Slingshot Finance right now:

- Install MetaMask or Trust Wallet on your browser or phone.

- Send ETH, USDC, or another token to your wallet.

- Go to slingshot.finance (no login needed).

- Connect your wallet.

- Select the token you want to trade and the chain you want to send it to.

- Review the quote - Slingshot shows real-time prices from all DEXs.

- Confirm the transaction in your wallet.

That’s it. No forms. No ID. No waiting. The whole process takes under 90 seconds.

What’s Next for Slingshot?

Slingshot’s roadmap isn’t public, but clues are everywhere. Magic Eden’s acquisition means NFT integration is coming. A native token is likely. A mobile app will drop in 2026. Staking and yield farming are probable next steps.

The big question: Can Slingshot sustain zero fees forever? Analysts say yes - if it grows fast enough. With Magic Eden’s backing, it’s not just surviving. It’s evolving.

For now, it’s a niche tool. But in a world where every exchange charges fees and holds your money, Slingshot Finance is one of the few that still believes users should own their crypto - and pay nothing to trade it.

Gaurav Mathur

February 13, 2026 AT 13:05