Sweden Cracks Down on Crypto Mining: Tax Incentives Gone

Oct, 14 2025

Oct, 14 2025

Crypto Mining Profitability Calculator

Sweden Tax Impact Calculator

Important: Sweden's energy tax increased from SEK 0.006 to SEK 0.36 per kWh (6,000% increase) effective July 2023.

When Sweden's cryptocurrency mining tax policy came under fire for its drastic reversal, the entire European mining landscape felt the tremor, operators suddenly faced a fiscal cliff. The move wiped out a generous 98% tax break that had drawn miners to the country’s cool climate and cheap hydro power, then added a punitive energy levy that made mining virtually unprofitable. If you’ve been tracking crypto news this year, you’ve probably wondered how such a sudden shift could happen and what it means for miners, investors, and regulators. Below you’ll find a step‑by‑step look at the policy, the numbers, and the fallout.

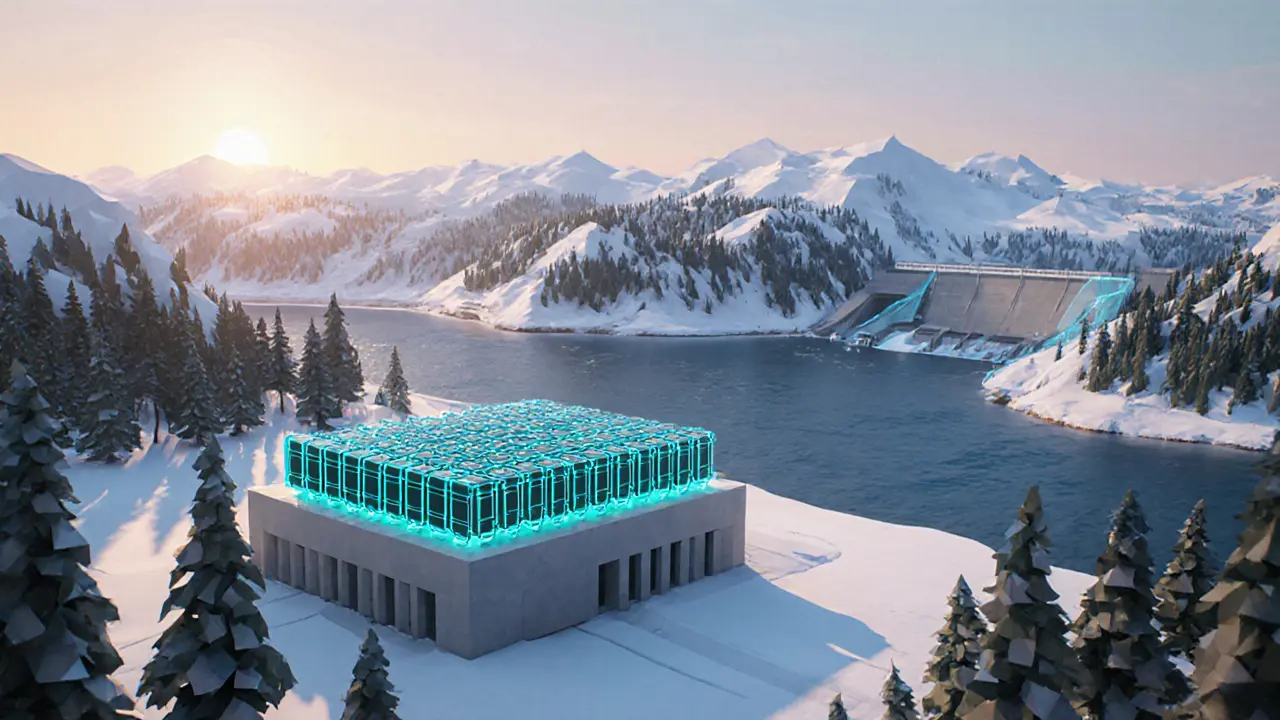

Why Sweden Was a Mining Magnet in the First Place

Back in 2017, Sweden introduced a 98% tax reduction for data‑center‑type facilities. The incentive was originally aimed at cloud providers and AI labs, but crypto miners quickly caught on. The country offered three key advantages:

- Abundant hydroelectric power generated by rivers in the north, delivering low‑cost, carbon‑light electricity.

- A naturally cool climate that reduced cooling costs for massive ASIC rigs.

- A stable regulatory environment that, at the time, seemed welcoming to digital‑asset businesses.

By 2022, the country hosted roughly 150MW of dedicated mining capacity, a figure that made it the last stronghold for European Bitcoin miners according to industry trackers.

The Policy U‑Turn: What Changed and When

In November 2022, Sweden’s budget announced a radical shift. Effective July 2023, the government did two things:

- Removed the 98% tax reduction entirely.

- Raised the energy tax for data‑center‑type loads from SEK0.006 to SEK0.36 per kilowatt‑hour, a 6,000% jump.

In plain English, miners went from paying pennies per kWh to roughly $0.035, a cost that dwarfs any revenue from most coins unless prices surge dramatically.

The legislation cited two main concerns:

- Minimal contribution to local employment and economic activity.

- Disproportionate energy consumption relative to public benefit.

Swedish officials also referenced the 2018 crypto crash, where abandoned mining farms left unpaid electricity bills and strained the grid.

Crunching the Numbers: Tax Impact in Detail

| Metric | Before July2023 | After July2023 |

|---|---|---|

| Tax reduction on data‑center electricity | 98% reduction | No reduction (full rates apply) |

| Energy tax per kWh | SEK0.006 (~$0.0006) | SEK0.36 (~$0.035) |

| Effective cost increase | - | ≈6,000% |

| Active mining capacity (MW) | ≈150MW | ≈5‑10MW (post‑shutdown) |

To put the jump in perspective, a 1TH/s ASIC rig that consumed 3kW would see its electricity bill rise from roughly $200 a month to $11,500 a month, wiping out any profit unless Bitcoin prices spiked by more than 800%.

Impact on Miners: From Stranded Assets to Relocation

Operators scrambled. Some chose to liquidate hardware locally at a loss; others booked expensive freight to move rigs to friendlier jurisdictions. The most common destinations?

- Kazakhstan - low electricity rates but higher political risk.

- U.S. states like Texas and Wyoming - abundant cheap wind and solar power.

- Canadian provinces such as Quebec and Alberta - still offer attractive hydro and natural‑gas tariffs.

Industry interviews revealed that a typical miner needed at least three months to dismantle a facility, arrange shipping, and secure new grid connections. The rapid policy rollout left many with “stranded assets”: purpose‑built bunkers, cooling systems, and high‑density power infrastructure that suddenly had no economic use.Community chatter on Reddit’s r/BitcoinMining crackled with frustration. One user summed it up: “Sweden just made mining impossible overnight. We’re packing up and heading west.”

How Sweden’s Approach Differs from Its Neighbours

Norway, Sweden’s fellow Nordic powerhouse, has also expressed concerns about mining’s energy draw, but it stopped short of punitive taxes. Instead, Norway focuses on voluntary carbon‑offset programs and encourages miners to use excess renewable capacity during off‑peak hours.

Contrast that with El Salvador, which actively subsidizes Bitcoin mining by offering cheap geothermal energy, or Texas, where the state government bills itself as a “crypto‑friendly haven” and even launched a mining‑focused utility rate plan.

The Swedish model stands out because its tax hike is not a modest surcharge-it’s a 6,000% increase that dwarfs any comparable levy in the EU. No other member state has yet introduced a similar punitive scheme, making Sweden a potential test case for governments that want to “tax out” unwanted industry activity.

What the Policy Means for the Broader Crypto Ecosystem

From an investor’s viewpoint, the Swedish crackdown removed a key source of relatively low‑cost hash power that helped keep Bitcoin’s network hashrate diversified across regions. The immediate effect was a temporary dip in global hashrate, followed by a quick rebound as miners migrated east and south.

Regulators elsewhere are watching closely. The European Union is drafting a “Digital Services Act”‑type framework that could include environmental caps on mining. Sweden’s hard‑line stance provides a data point: heavy taxation can indeed force an industry out, but it also raises questions about capital flight and the loss of potential tech‑jobs that could have been created with a more balanced approach.

For miners still weighing where to set up shop, a simple rule of thumb has emerged: calculate the total cost of electricity per kilowatt‑hour (including taxes) and compare it to the projected revenue per megahash. If the break‑even price exceeds the current market price by more than 30%, the operation is unlikely to survive long‑term.

Looking Ahead: Will Sweden Keep Its Hard Stance?

As of late 2023, commercial mining in Sweden is effectively dead. The government’s stated goal-to deter mining that offers “minimal economic benefit”-has been achieved. Yet political winds can change. A new coalition could revisit the policy if a future energy surplus makes cheap power widely available again.

In the meantime, the Swedish case is being cited in policy workshops across Brussels, Stockholm, and Berlin as a cautionary tale of using tax law as a blunt instrument. Academics argue that a more nuanced approach-like a carbon‑price floor combined with a modest energy surcharge-might achieve environmental goals without prompting a full industry exodus.

For now, the lesson is clear: governments can wield tax policy to shape the geography of crypto mining, and miners must stay agile enough to relocate at a moment’s notice.

Frequently Asked Questions

What exactly did Sweden change in its tax code?

Sweden eliminated the 98% tax reduction for data‑center electricity and raised the energy tax from SEK0.006 to SEK0.36 perkWh, a 6,000% increase that applies to all high‑consumption facilities, including cryptocurrency miners.

Why did the government target crypto miners specifically?

Officials argued that mining contributed little to local employment and strained the power grid without delivering proportional economic benefits, especially after the 2018 market crash left unpaid electricity bills.

How does the new tax compare to other European countries?

Sweden’s 6,000% hike far exceeds any EU counterpart. Norway imposes no extra mining tax; Germany and France focus on energy‑efficiency regulations rather than direct fiscal penalties.

What are the main destinations for relocated Swedish miners?

Most have moved to Kazakhstan, Texas, Wyoming, and Canadian provinces like Quebec, where electricity remains cheap and regulatory frameworks are friendlier.

Will the policy affect non‑crypto data centers?

Yes. The energy tax applies to any high‑consumption facility, so cloud providers and AI labs now face higher electricity costs as well.

Kyla MacLaren

October 14, 2025 AT 08:32That tax jump is a real bummer for miners.

Linda Campbell

October 14, 2025 AT 14:05The Swedish government's recent policy reversal represents a flagrant betrayal of economic freedom. By eliminating the 98% tax reduction, Stockholm has effectively nationalized the profits of private miners. The astronomical six‑thousand percent increase in energy tax is nothing short of punitive taxation. Such measures demonstrate a reckless disregard for the entrepreneurial spirit that drives innovation. Moreover, this decision threatens to destabilize the broader European cryptocurrency ecosystem. Investors who once regarded Sweden as a haven are now forced to reconsider their exposure. The policy also raises serious questions about the rule of law and predictability of regulation. When a nation can so abruptly alter fiscal incentives, confidence in its market governance erodes. Citizens should demand transparency and a more balanced approach that does not punish emerging technology. It is incumbent upon policymakers to recognize the long‑term benefits of a thriving digital‑asset sector. Instead of encouraging sustainable mining practices, the government has opted for an outright ban of profitability. This heavy‑handed tactic will inevitably drive capital to more welcoming jurisdictions such as the United States or Canada. The loss of Swedish mining capacity may also impair the nation's aspirations for green energy leadership. In sum, the tax hike is an ill‑advised move that undermines both economic growth and environmental ambition. Those who cherish free markets must stand united against such oppressive fiscal overreach.

John Beaver

October 14, 2025 AT 19:39Just to put numbers on it, a 1TH/s ASIC that sips 3kW now hauls a $11,500 monthly electric bill under the new levy. That dwarfs any realistic Bitcoin revenue unless the price rockets past $200k. The previous tax break made those rigs marginally profitable at $30‑$40/kWh. So the policy shift literally flips the profit‑loss equation overnight. If you’re still running a farm, you either have to shut down or relocate.

EDMOND FAILL

October 15, 2025 AT 01:12Looks like Sweden just turned the crypto mining playground into a tax swamp. The chill vibe there vanished the moment the energy levy shot up. Miners now have to weigh the cost of electricity against the ever‑volatile coin prices.

Jennifer Bursey

October 15, 2025 AT 06:45Exactly, the shift redefines the whole cost‑benefit calculus. When you factor in cooling overhead, network latency, and regulatory risk, the total TCO skyrockets. It’s a classic case of policy‑induced market reallocation, pushing capital toward jurisdictions with favorable power tariffs and supportive legal frameworks.

Maureen Ruiz-Sundstrom

October 15, 2025 AT 12:19The whole affair reads like a cautionary tale about short‑term political whims overriding long‑term economic strategy. Sweden sacrificed a burgeoning tech niche for a fleeting echo of energy sovereignty. In the end, they lose both the tax revenue and the innovative edge they once cultivated.

Bruce Safford

October 15, 2025 AT 17:52What most folks dont see is the behind‑the‑scenes push from big energy lobbies. They wnt to keep cheap power for trad power plants, so they sabotage green tech like crypto mining. Its all part of the grand plan to keep the old guard in charge. Dont be fooled by the official narrative.

Shrey Mishra

October 15, 2025 AT 23:25From an ethical standpoint, this heavy‑handed taxation could be justified if the mining operations were causing undue environmental strain. Yet the abruptness suggests a lack of genuine concern for sustainability, leaning more toward revenue extraction.

Ken Lumberg

October 16, 2025 AT 04:59Morally speaking, the state's duty is to protect its citizens from exploitative practices, but it must also honor contracts made in good faith. Punishing miners after they invested heavily feels like a breach of trust.

Blue Delight Consultant

October 16, 2025 AT 10:32One might argue that the swift policy change reflects the tension between technological progress and traditional energy paradigms. It invites a broader reflection on how societies negotiate the boundaries of innovation.

Wayne Sternberger

October 16, 2025 AT 16:05For those still navigating this transition, consider diversifying your energy sources or exploring jurisdictions with stable regulatory frameworks. It’s essential to align operational strategies with long‑term policy stability.

Gautam Negi

October 16, 2025 AT 21:39Contrary to popular belief, the collapse of Swedish mining may actually benefit the global network by decentralizing hash power. Concentration in one region poses systemic risks that this upheaval inadvertently mitigates.

Shauna Maher

October 17, 2025 AT 03:12Don't be fooled by the techno‑optimist narrative. This is a classic case of elite interests manipulating policy to force out competition. The real agenda is to keep the power grid under exclusive control.

Shane Lunan

October 17, 2025 AT 08:45Looks like some people just love to stir drama for drama's sake.

Maria Rita

October 17, 2025 AT 14:19While the conspiratorial spin is tempting, let's focus on actionable steps: relocate, renegotiate contracts, and advocate for transparent policy making. Unity and practical planning will outlast any rumor‑driven panic.