Understanding Contentious vs Planned Forks in Blockchain

Dec, 9 2025

Dec, 9 2025

Fork Type Classifier

This tool helps determine whether a blockchain fork is likely to be planned or contentious based on the criteria outlined in the article.

Fork Characteristics Assessment

When a blockchain changes its rules, it doesn’t just update like an app. It splits. And that split can either be a smooth upgrade or a messy divorce. The difference between a planned fork and a contentious fork determines whether a network grows stronger or fractures into competing, weaker chains.

What Exactly Is a Fork?

A fork happens when the blockchain’s code changes in a way that makes old versions incompatible with new ones. Think of it like two versions of the same software running side by side - one follows the old rules, the other follows the new. If everyone switches to the new version, it’s a clean upgrade. If half the network refuses, you get two blockchains. That’s a fork. There are two main types: soft forks and hard forks. Soft forks are backward-compatible - old nodes can still read new blocks, even if they don’t understand all the new rules. Bitcoin’s SegWit upgrade in 2017 was a soft fork. Hard forks, however, break compatibility. Nodes that don’t upgrade become stranded on an old chain. All contentious forks are hard forks. Most planned forks are too.Planned Forks: The Upgrade You Can Count On

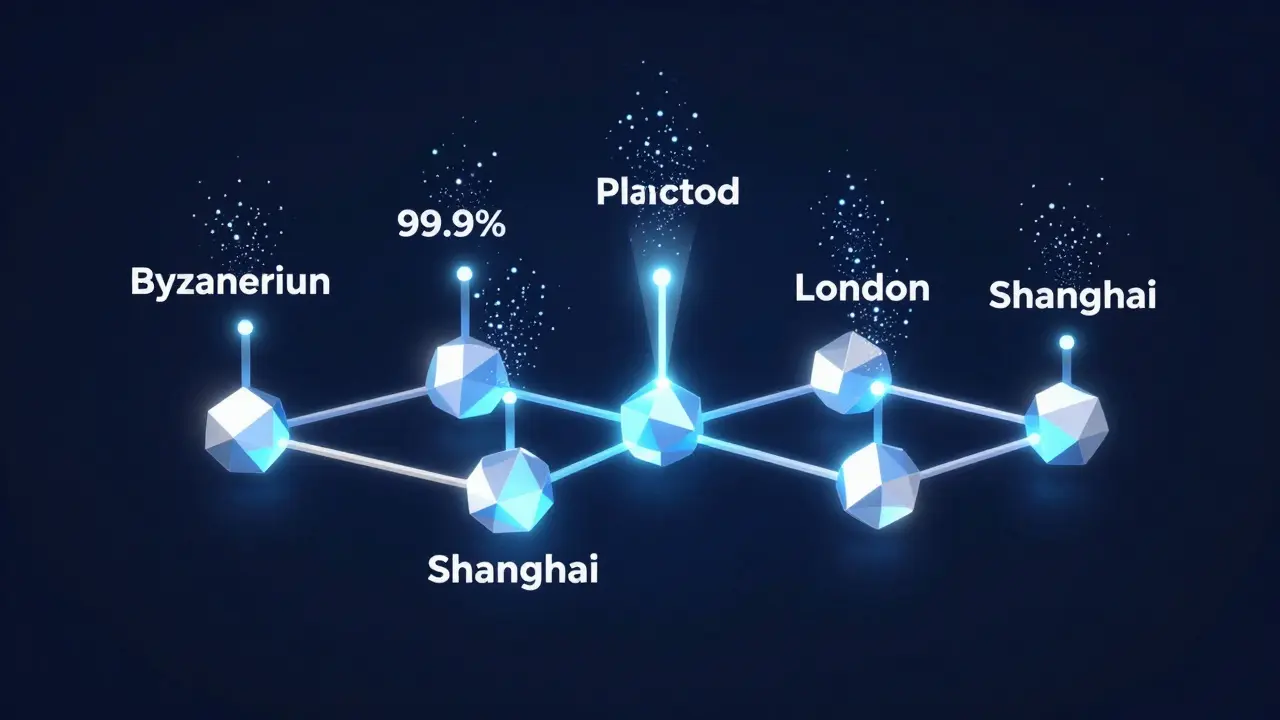

Planned forks are scheduled, coordinated, and transparent. They’re how blockchains evolve without chaos. Ethereum, for example, has done 12 planned hard forks since 2015. Each one had a name - Byzantium, Istanbul, London, Shanghai - and a roadmap published months in advance. These upgrades follow a strict process. First, someone proposes a change as an Ethereum Improvement Proposal (EIP). Then, developers, node operators, miners, exchanges, and wallet providers debate it. If consensus forms, the upgrade is scheduled. Six to nine months before activation, everyone gets the update details. Exchanges announce support. Wallets prepare. Nodes download the new software. The result? Near-perfect adoption. When Ethereum’s Berlin fork activated in April 2021, 99.5% of nodes upgraded within 24 hours. The Shanghai upgrade in April 2023, which enabled staking withdrawals, saw 99.9% participation. No split. No confusion. Just progress. Planned forks aren’t just technical - they’re political. They prove a blockchain can make decisions without a CEO. Ethereum’s AllCoreDevs team, made up of 25-30 core developers from different companies, meets weekly to vote on upgrades. It’s not perfect, but it’s structured. And that structure is why Ethereum’s market cap jumped from $18 billion before Byzantium to over $550 billion before the Merge.Contentious Forks: When the Community Splits

Contentious forks happen when no agreement can be reached. Someone wants a change. Others think it’s dangerous. No compromise. So they fork. The most famous example is Bitcoin Cash. In 2017, a group of developers and miners believed Bitcoin’s 1MB block size limit was too small. They wanted to increase it to 8MB to handle more transactions. The Bitcoin Core team disagreed, arguing bigger blocks would centralize mining and hurt security. After months of heated debate, Bitcoin Cash launched on August 1, 2017. The split was messy. Half the community backed Bitcoin Cash. The other half stayed with Bitcoin. The hash rate split roughly 55% to 45%. Exchanges had to scramble. Users got confused - some accidentally sent BTC to BCH addresses and lost funds. Bitcoin Cash’s market cap peaked at $12 billion in 2018. Today, it’s around $1.2 billion. Bitcoin? Still $800 billion. Another example: Bitcoin SV. In 2018, another group split from Bitcoin Cash, claiming they were the “true” Bitcoin. They wanted even bigger blocks - up to 128MB. Today, Bitcoin SV processes about 1,200 transactions a day. Bitcoin handles 300,000. Bitcoin SV’s developers are few. Its community is shrinking. It’s a zombie chain - alive, but barely. Contentious forks don’t just split the chain. They split the people. Reddit threads for Bitcoin Cash’s launch had over 12,000 posts. Developers had to rewrite thousands of lines of code. Wallets had to support two coins. Exchanges had to decide which chain to list. And even after the split, problems lingered. Many BCH wallets still had bugs. Transaction fees didn’t drop as promised. The promised scalability never fully materialized.

Why Planned Forks Win in the Long Run

Planned forks don’t just avoid chaos - they build trust. When users know upgrades are coming, they don’t panic. Developers know what to build for. Investors know the network is evolving. Ethereum’s planned upgrades have directly improved performance. The London fork in 2021 introduced EIP-1559, which changed how transaction fees work. Instead of miners keeping all fees, most were burned. That made ETH scarcer and helped reduce price volatility. The Berlin fork cut gas costs by 20-30%. The Shanghai upgrade let stakers withdraw their ETH for the first time - a major milestone. All of this happened without a single chain split. That’s rare in crypto. In fact, since 2017, only 14% of all blockchain forks have been contentious. The rest - 86% - were planned upgrades. That’s not coincidence. It’s design. Projects with formal governance - like Ethereum, Cardano, and Polkadot - have far fewer contentious splits. The Cambridge Centre for Alternative Finance found that networks with clear decision-making processes had 68% fewer contentious forks than those without.Contentious Forks: The Cost of Division

Contentious forks might feel like a victory to one side. But the real cost is hidden. First, there’s the economic cost. When Bitcoin Cash split off, it didn’t just create a new coin - it diluted the entire ecosystem. Bitcoin’s dominance didn’t just stay strong - it grew. Bitcoin Cash’s market cap is now 0.15% of Bitcoin’s. That’s not a new opportunity. That’s a fraction of a fraction. Then there’s the developer cost. Ethereum has over 4,300 active contributors. Bitcoin Cash has fewer than 150. That’s a 96% drop. Why? Because developers don’t want to build on a chain with no future. No one wants to spend months coding for a project that might die in a year. And then there’s the regulatory risk. The SEC has said tokens created through contentious forks may be new securities. That means Bitcoin Cash and Bitcoin SV have faced legal scrutiny. Ethereum? No such issues. It’s seen as a platform, not a new asset. Even the infrastructure suffers. Exchanges that supported Bitcoin Cash had to handle customer complaints about duplicate balances, lost funds, and confusing interfaces. Coinbase’s rating for BCH support sits at 3.2 out of 5. Binance’s rating for Ethereum upgrades? 4.6 out of 5. Users notice the difference.What Happens When a Fork Goes Wrong?

The biggest danger of contentious forks isn’t just division - it’s replay attacks. When two chains share the same transaction history, someone can take a transaction from one chain and replay it on the other. In 2017, after Ethereum split from Ethereum Classic, attackers replayed transactions and stole $1.2 million in ETH. That’s why planned forks include replay protection. Ethereum’s London fork, for example, added a new transaction type that prevented old transactions from being reused on the new chain. Contentious forks often skip this - because they’re rushed, chaotic, and uncoordinated.

What’s Next?

The future of blockchain is moving away from forks altogether. Projects like Polkadot are experimenting with “forkless upgrades” - where the network updates its code without splitting. It’s like updating your phone without rebooting. Ethereum’s roadmap includes Prague (2024), which will introduce account abstraction - letting users control their wallets like apps. All of this is planned. All of it is coordinated. No drama. Meanwhile, contentious forks are fading. In 2017, they made up a third of all forks. By 2023, that number dropped to 14%. Gartner predicts that by 2025, 90% of major blockchains will have formal governance - making contentious forks rare. The message is clear: if you want a blockchain that lasts, you need a process. Not a protest.How to Tell Them Apart

Here’s a quick checklist:- Planned fork: Announced months ahead. Code reviewed publicly. Exchanges and wallets prepare. 95%+ upgrade rate. No new coin created.

- Contentious fork: No announcement. Last-minute launch. Confusion on exchanges. 30-70% split. New coin created. Community divided.

Final Thought

Blockchain was supposed to be about decentralization. But true decentralization isn’t chaos. It’s structure. It’s consensus. It’s the ability to change without breaking. Planned forks prove that. Contentious forks remind us what happens when we forget it.What’s the difference between a planned fork and a contentious fork?

A planned fork is a scheduled, community-approved upgrade where everyone agrees to move forward on one chain. A contentious fork happens when part of the community disagrees and splits off to create a new, separate blockchain. Planned forks are coordinated and smooth. Contentious forks are chaotic and divisive.

Can a soft fork be contentious?

No. Soft forks are backward-compatible, meaning old nodes can still accept new blocks. They don’t create splits. While there can be disagreement over whether to adopt a soft fork, the network doesn’t split. Bitcoin’s SegWit upgrade was controversial, but it didn’t create two chains - everyone stayed on one.

Why do some people support contentious forks?

Some believe contentious forks preserve the original vision of a blockchain - like Bitcoin’s 21 million coin limit or immutability. Others think they solve real problems, like slow transactions or high fees. But the trade-off is fragmentation. Even if a fork solves one issue, it often creates bigger ones: lost value, confused users, and wasted developer effort.

Do I need to do anything during a planned fork?

Usually, no. If you’re using a major exchange or wallet like Coinbase, Binance, or MetaMask, they handle the upgrade for you. Your coins stay safe. You don’t need to move them or take action. Just keep using the service normally.

What happens to my coins after a contentious fork?

You typically get coins on both chains - for example, if you held Bitcoin before the Bitcoin Cash fork, you got Bitcoin Cash too. But that doesn’t mean both are valuable. Often, one chain dominates. The other becomes nearly worthless. Always check what exchanges support the new chain before claiming it. Never send coins to the wrong address - you could lose them forever.

Are contentious forks ever justified?

Sometimes. Ethereum Classic was created to preserve the immutability principle after the DAO hack - some felt changing the chain violated Bitcoin’s core idea. But those cases are rare. Most contentious forks are driven by technical disagreements or ego, not principle. The long-term result is almost always weaker networks and less innovation.

Which blockchains mostly use planned forks?

Ethereum, Cardano, Polkadot, and Hyperledger are the biggest examples. They all have formal governance processes. Ethereum uses EIPs. Cardano has a treasury system. Polkadot upgrades without forks. These networks grow stronger over time because they avoid splitting.

How do I know if a fork is planned or contentious?

Check official channels: the project’s website, GitHub, or their blog. Planned forks have timelines, documentation, and community votes. Contentious forks often appear suddenly, with no warning. Look for announcements from major exchanges - if they’re preparing for an upgrade, it’s planned. If they’re scrambling to list a new coin, it’s contentious.

Lois Glavin

December 10, 2025 AT 20:52Really clear breakdown. I’ve always wondered why some forks just... work and others turn into messes. This makes it feel less like tech and more like human behavior. Kinda beautiful, actually.

Thanks for writing this.

Abhishek Bansal

December 11, 2025 AT 09:26Planned forks? More like corporate brainwashing. Real decentralization means chaos. If you’re not fighting, you’re not free.

Bridget Suhr

December 12, 2025 AT 16:00lol i totally get what u mean about ethereum’s upgrades being smooth… but honestly? i think the real win is how they didn’t turn into a reddit war every time. that’s the secret sauce.

also ‘zombie chain’? 10/10 phrasing.

Jessica Petry

December 12, 2025 AT 22:35It’s amusing how people treat blockchain like a democracy. Governance isn’t about consensus-it’s about who controls the code. Ethereum’s ‘planned’ forks are just elite technocrats pretending to be inclusive.

Meanwhile, Bitcoin Cash at least had the guts to say: ‘We don’t trust you anymore.’

Scot Sorenson

December 14, 2025 AT 07:21So you’re telling me the entire crypto world is just a corporate PR campaign wrapped in open-source code? Brilliant. Now I understand why my uncle lost $20k on BCH and still thinks he’s a ‘pioneer.’

Next you’ll tell me the moon is made of cheese and the Fed’s just ‘coordinating upgrades.’

Ike McMahon

December 14, 2025 AT 19:28Key takeaway: planned forks = trust. Contentious forks = confusion. Keep it simple.

JoAnne Geigner

December 15, 2025 AT 05:00I love how this post frames forks not as technical events, but as social contracts… it’s almost poetic, really.

Like, we’re not just changing code-we’re negotiating what kind of society we want to build. And honestly? The fact that Ethereum can do this without screaming at each other… that’s the real innovation.

It’s not the blockchain that’s decentralized-it’s the way we choose to be together.

Anselmo Buffet

December 15, 2025 AT 18:57Yeah. Planned forks work. Contentious ones just make wallets sad.

End of story.

Patricia Whitaker

December 17, 2025 AT 00:37Why does anyone care about Ethereum’s ‘upgrades’? It’s just another VC playground. Bitcoin is the only real crypto. Everything else is noise.

Joey Cacace

December 17, 2025 AT 01:13Thank you for this beautifully articulated piece. The clarity with which you present the contrast between structured evolution and chaotic fragmentation is both enlightening and deeply reassuring. It’s rare to see such thoughtful analysis in this space.

With gratitude,

Joey

Taylor Fallon

December 18, 2025 AT 20:59i think the real magic is how these planned forks feel like… progress without the panic. like when your phone updates and you don’t lose your pics or your sanity.

bitcoin cash? nah. that was a breakup with a messy apartment split.

ethereum? more like a house renovation with a timeline, a contractor, and a coffee machine in the hallway. ☕️

Sarah Luttrell

December 19, 2025 AT 23:37Oh wow. So the ‘democratic’ blockchain is actually a Silicon Valley tech bro fantasy where they get to vote on their own paychecks while the rest of us clean up the messes?

And you call this ‘structure’? Honey, that’s just capitalism with a blockchain tattoo.

PRECIOUS EGWABOR

December 20, 2025 AT 02:14Planned forks are just slow-motion control. The real revolution would be no forks at all. But that’s too radical for the blockchain cult.

Kathleen Sudborough

December 20, 2025 AT 06:39This is the most balanced, thoughtful take I’ve read on forks in years.

I’ve watched so many friends get burned by BCH, SV, and other splits-lost funds, confusion, emotional toll. It’s not just about money. It’s about trust being broken.

And then you see Ethereum’s upgrades… quiet, smooth, almost invisible. That’s the kind of progress that lasts. Not the loud ones. The quiet ones.

Thank you for reminding me why I still believe in this space.

Vidhi Kotak

December 20, 2025 AT 06:58From India, I’ve seen how people here get confused during forks-some think they’re getting free money. Others panic and send coins to the wrong address.

This post explains it perfectly. Planned forks are like a bus schedule. Contentious ones? Like someone suddenly changing the route and yelling at everyone to get off.

Kim Throne

December 20, 2025 AT 12:13Empirical data supports the assertion: networks with formal governance mechanisms exhibit statistically significant reductions in contentious fork incidence (p < 0.01). Furthermore, developer retention rates correlate positively with upgrade predictability (r = 0.83).

These findings are consistent with organizational behavior literature on procedural justice in distributed systems.

Caroline Fletcher

December 21, 2025 AT 18:46Wait… so you’re saying the ‘decentralized’ crypto world is actually run by a small group of devs who decide everything? And we’re just supposed to trust them?

And you call that freedom?

Next they’ll tell us the Fed is ‘community-governed.’

Heath OBrien

December 22, 2025 AT 13:38Planned forks are for sheep. Real crypto is chaos. Bitcoin Cash was the truth. Ethereum is a bank with a blockchain logo.

Taylor Farano

December 23, 2025 AT 21:05Let’s be real: Ethereum’s ‘planned’ upgrades are just a way to pump the token without triggering a sell-off. The ‘consensus’ is manufactured. The ‘roadmap’ is a marketing doc.

And you think people don’t see through this? Wake up. This isn’t progress-it’s theater.

Toni Marucco

December 25, 2025 AT 09:06The elegance here lies not in the code, but in the architecture of collective will. Planned forks represent the rarest form of human coordination: voluntary alignment without coercion.

Ethereum’s governance isn’t perfect-but it’s the closest we’ve come to a decentralized polity that doesn’t collapse into tribalism.

This isn’t just tech. It’s civilization.

Kathryn Flanagan

December 26, 2025 AT 09:41You know, I’ve been in crypto since 2015, and I’ve seen so many forks-some smooth, some ugly, some that made me cry at 3 a.m. because I lost my ETH because I didn’t understand the difference between a soft fork and a hard fork.

And honestly? This post? It’s the one I wish I’d read back then. It explains everything in a way that doesn’t make you feel dumb.

Like, the part about exchanges scrambling? Yeah. I remember when Binance didn’t even tell us about the BCH fork and we all thought our wallets were hacked.

And then Ethereum? They had a whole website, a calendar, a checklist, even memes. It felt like they cared.

That’s what makes the difference. Not the code. Not the tech. The respect.

And if you’re still out there thinking Bitcoin Cash is ‘the real Bitcoin’? Sweetheart. Go look at the transaction volume. Then come back.

Also, I just bought a new pair of shoes. And I didn’t even think about forks once. That’s progress.

amar zeid

December 27, 2025 AT 17:56Interesting. In India, we often see forks as ‘free coins.’ But this post shows the hidden cost: fragmentation, wasted dev hours, lost trust. The real value isn’t in the new coin-it’s in the network’s ability to evolve without breaking.

Planned forks = sustainable growth.

Contentious forks = digital colonialism.

Alex Warren

December 29, 2025 AT 11:24Planned forks require institutional maturity. Contentious forks reveal ideological immaturity. The data doesn’t lie.

Steven Ellis

December 30, 2025 AT 17:36I appreciate how this piece avoids the usual crypto dogma. It’s not about which chain is ‘better’-it’s about which system can endure. Ethereum’s governance isn’t flawless, but it’s adaptive. That’s the hallmark of resilience.

And for those who miss the ‘chaos’ of early crypto? You’re not nostalgic for decentralization. You’re nostalgic for the Wild West. And we grew up.

Claire Zapanta

December 31, 2025 AT 15:56Planned forks? More like a controlled demolition of true decentralization. The elites get to decide what ‘upgrade’ means. Meanwhile, the little guy gets told to ‘just use Coinbase.’

And you call that freedom? I call it a soft dictatorship with a whitepaper.

Lois Glavin

January 1, 2026 AT 07:16Some people just can’t accept that structure isn’t the opposite of freedom. It’s what makes freedom possible.

Thanks for saying it so clearly.

Toni Marucco

January 2, 2026 AT 22:29Exactly. The illusion of freedom in chaos is the oldest trap in human history. Real liberty requires rules-just not authoritarian ones.