Understanding Impermanent Loss in DeFi with Real Examples

Feb, 9 2026

Feb, 9 2026

When you put your crypto into a liquidity pool on a decentralized exchange like Uniswap or SushiSwap, you might think you’re just earning fees. But there’s a hidden catch: impermanent loss. It’s not a glitch. It’s built into how these systems work. And if you don’t understand it, you could lose money-even when the price of your coins goes up.

What Is Impermanent Loss?

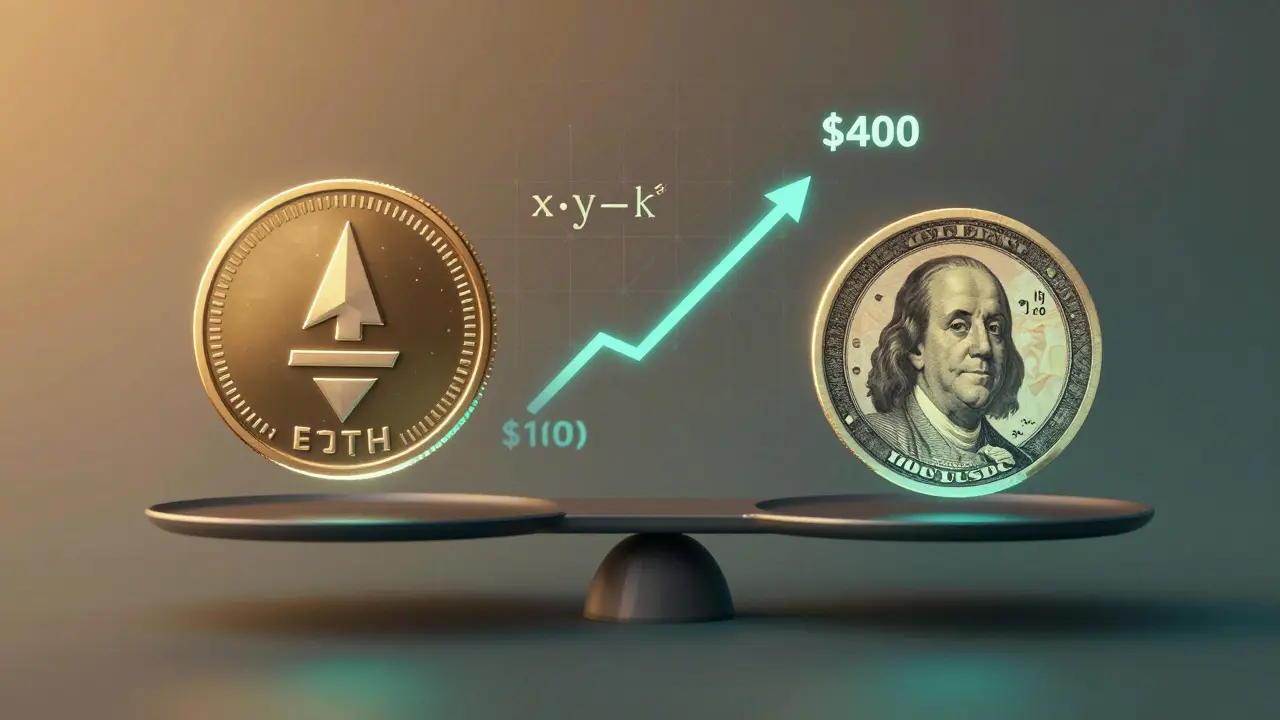

Impermanent loss happens when the value of the two tokens you deposit into a liquidity pool changes relative to each other. It’s called "impermanent" because if the prices return to where they started, the loss disappears. But if they don’t? You end up with less than if you’d just held the coins in your wallet. Think of it like this: you put in 1 ETH and 100 USDC. At that moment, ETH is $100. You own a 50/50 split of the pool. A few days later, ETH rises to $400. The pool rebalances automatically to match the market price. Now, you have less ETH and more USDC than you started with. Even though ETH is worth more, your share of the pool doesn’t reflect that gain. You lost out on the full upside.How Does It Actually Happen?

All major decentralized exchanges use something called an Automated Market Maker (AMM). The most common one uses a formula: x × y = k. Here, x and y are the quantities of two tokens in the pool, and k is a constant. The system keeps this product stable, so when someone trades, the ratio of tokens adjusts to keep k unchanged. When ETH goes from $100 to $400, traders buy ETH from the pool because it’s cheaper than on other exchanges. As they buy, the pool gives up ETH and gains USDC. The pool’s ratio shifts. When you withdraw, you get back a mix of ETH and USDC based on this new ratio. But here’s the kicker: you now have less ETH than you originally put in. And even though ETH is worth more, your total value might still be lower than if you’d just held it.Real Example: ETH and USDC

Let’s walk through a real scenario. You deposit 1 ETH and 100 USDC into a pool. At the time, ETH is $100. Your total deposit is $200. The pool now holds 1 ETH and 100 USDC. A week later, ETH hits $400. Arbitrage traders notice the pool’s ETH is still priced at $100 (because the AMM doesn’t update instantly). They buy ETH from the pool, paying USDC. The pool now has 0.5 ETH and 200 USDC. Why? Because to keep x × y = k, when ETH’s price doubles, the amount of ETH in the pool must drop by half. You withdraw. You get 0.5 ETH and 200 USDC. That’s $400 total. Sounds good? But wait-you started with 1 ETH worth $100. If you’d just held it, you’d now have 1 ETH worth $400. That’s $400 in value. But because you provided liquidity, you only have $400 total. You lost the extra $100 you would’ve gained from ETH’s price rise. That $100 difference? That’s impermanent loss. You didn’t lose money overall-you still have $400-but you missed out on $100 in potential gains.What About Stablecoin Pairs?

Not all pairs are equal. If you put in USDC and USDT, you’re unlikely to see any impermanent loss. Why? Because their prices barely move. They’re both designed to stay at $1. So even if one dips to $0.999 and rises back to $1.001, the effect is tiny. That’s why many beginners start with stablecoin pairs. They earn trading fees without worrying about big price swings. Fees from stablecoin pools are lower, but the risk is near zero. For someone new to DeFi, that’s a smart way to learn.

High Volatility = High Risk

Now consider ETH and SOL. Both are volatile. If ETH goes up 50% and SOL drops 30%, the pool rebalances hard. Your share gets skewed toward the token that lost value. You end up with more of the loser and less of the winner. Even if the overall market is up, your position might be down. Studies from TastyCrypto show that for pairs with price changes over 30%, impermanent loss can hit 10% or more. At 50% divergence, losses can reach 25%. And at 100% price swings? You could lose over 50% of your potential gain. But here’s the flip side: high volatility means more trading. More trading means more fees. If ETH/SOL has heavy volume, the fees you collect over time might cover the loss-and then some. Some experienced users wait for bull runs, knowing fees will pile up. They accept short-term loss for long-term gain.Fee Rewards: The Trade-Off

Liquidity providers earn a cut of every trade in their pool. Most DEXs charge 0.3% per trade. High-volume pools like ETH/USDC or WBTC/ETH can generate hundreds or even thousands of dollars in fees per month. If you’re in a pool with $10 million in liquidity and the daily trading volume is $1 million, you’re earning 0.3% of that. That’s $3,000 a day in fees. Spread across all providers? Still, your share could be $10-$50 a day. That adds up fast. The key is balancing fees against loss. If your pair moves 20% and you earn $200 in fees over a month, but your impermanent loss is $150? You’re ahead. If the pair barely moves and you earn $20 in fees but lose $100? You’re worse off.How to Protect Yourself

You can’t eliminate impermanent loss. But you can manage it.- Start with stablecoins. USDC/USDT, DAI/USDC. Zero volatility, low risk.

- Avoid extreme pairs. Don’t put ETH and a new meme coin in together. The risk is too high.

- Use concentrated liquidity. Uniswap V3 lets you set price ranges. Your funds only work within a specific range. If the price stays there, you earn more fees and lose less.

- Track with calculators. Sites like impermanentloss.com let you plug in numbers and see how much you’d lose if prices change.

- Don’t rush in. Wait for market calm. Big moves happen fast. If ETH spikes overnight, you’re already behind.

Why It’s Not a Bug-It’s a Feature

Some people think impermanent loss is a flaw. It’s not. It’s how AMMs stay fair. Without it, traders could exploit pools forever. The system forces liquidity providers to absorb price changes so the market stays balanced. Kraken puts it simply: "It’s not a failure-it’s the cost of providing liquidity." You’re not just a passive investor. You’re acting like a market maker. And market makers don’t get to keep all the upside. They take on risk.What Happens When Prices Return?

Here’s the hopeful part: if the price goes back to where it started, the loss vanishes. That’s why it’s called "impermanent." Say ETH drops from $400 back to $100. The pool rebalances again. You get back close to your original 1 ETH and 100 USDC. The loss disappears. But if you withdrew at $400, you’d have locked in the loss. Timing matters. Many long-term providers hold through cycles. They ride out the ups and downs, letting fees compound. Some users report earning more in fees over six months than they lost in impermanent loss during a single bear market.Is It Worth It?

Yes-if you know what you’re doing. If you’re new, start small. Use stablecoins. Learn how fees add up. Watch how prices move. Then try a low-volatility pair like ETH/USDC. If you’re experienced, you can target high-fee pools with smart entry points. But never assume the price will go up. Always assume it might swing hard. And always calculate the loss before you deposit. Impermanent loss isn’t scary. It’s just math. And math can be understood. Once you get it, you stop seeing liquidity pools as "free money." You see them as tools-with rules, risks, and rewards.Is impermanent loss the same as losing money?

No. Impermanent loss isn’t a loss of your principal-it’s a missed opportunity. You still have your assets, but they’re worth less than what you’d have if you’d held them outside the pool. If prices return to their original ratio, the loss disappears. That’s why it’s called "impermanent."

Can you avoid impermanent loss completely?

Not entirely, but you can minimize it. Use stablecoin pairs like USDC/USDT-they rarely move, so loss is near zero. Use concentrated liquidity pools (Uniswap V3) to limit your exposure to price ranges. Avoid pairing highly volatile assets like a new altcoin with ETH. And always check fee yields against potential loss before depositing.

Do all decentralized exchanges have impermanent loss?

Yes, if they use an Automated Market Maker (AMM) with a constant product formula like x*y=k. That includes Uniswap, SushiSwap, Curve, and Balancer. Centralized exchanges don’t have it because they use order books, not liquidity pools.

How do I calculate my own impermanent loss?

Use an online calculator like impermanentloss.com or DeFiLlama’s tool. You’ll need to input: the starting price of both tokens, the current price, and the ratio of your deposit (usually 50/50). The tool will show you the percentage loss and what your final asset split would be. Many DeFi wallets also show estimated loss directly in the interface.

Can trading fees cover impermanent loss?

Yes, often they do. In high-volume pools like ETH/USDC or WBTC/ETH, fees can easily exceed losses over a few months. For example, if you lose 15% in impermanent loss but earn 20% in fees over the same period, you’re ahead. But in low-volume pools, fees might not be enough. Always compare estimated fees to projected loss before committing.

Gaurav Mathur

February 9, 2026 AT 07:22you think you're earning fees but really you're just funding arbitrage bots

no one tells you this but thats how it works