What Happens During a Blockchain Fork: Soft, Hard, and How Communities Split

Dec, 19 2025

Dec, 19 2025

When a blockchain forks, it doesn’t just update-it splits. One chain becomes two, and suddenly there are two versions of the same ledger, each with its own history, users, and rules. This isn’t a glitch. It’s how decentralized networks grow, argue, and sometimes break apart.

What Exactly Is a Blockchain Fork?

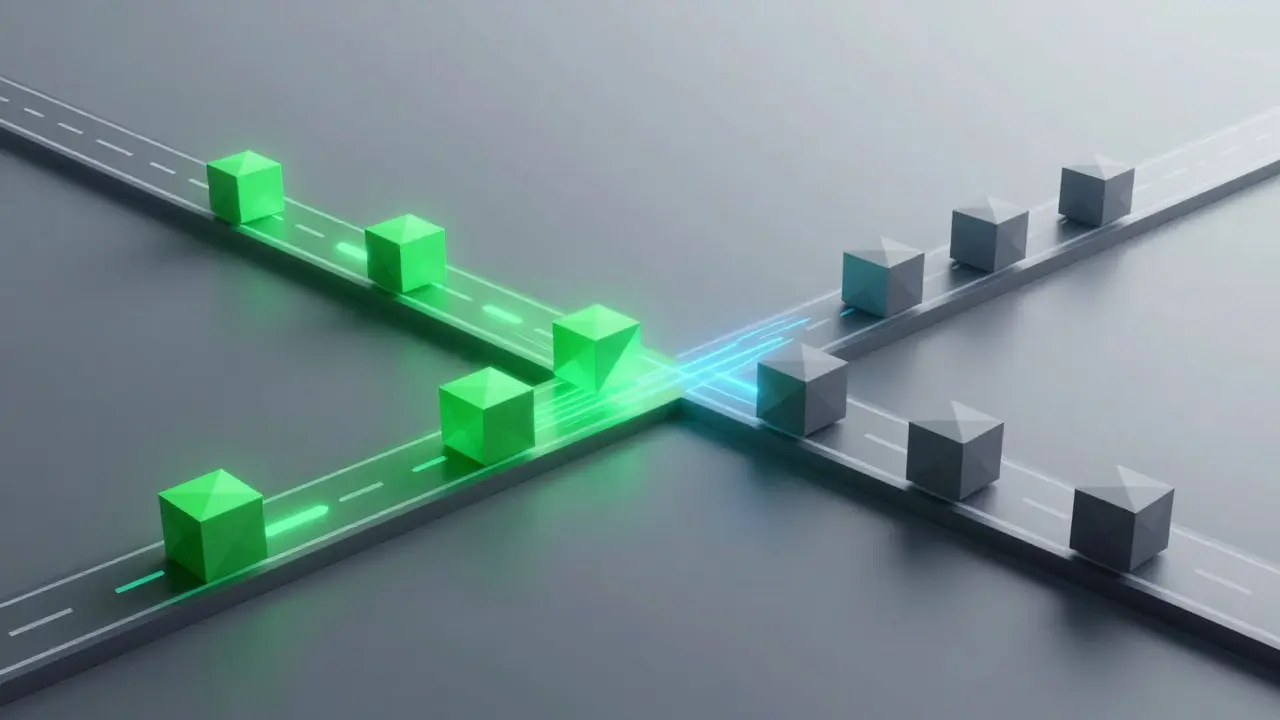

A blockchain fork happens when the software running the network disagrees on the rules. Think of it like a road that suddenly splits into two lanes. Up until the fork point, everyone was driving the same way. After that? One group follows new rules, the other sticks to the old ones. This isn’t a software bug. It’s intentional. Forks are how blockchains upgrade without a boss telling everyone what to do. No CEO. No IT department. Just code and consensus. There are two main types: soft forks and hard forks. They’re not just different in name-they’re fundamentally different in how they work.Soft Forks: Backward-Compatible Upgrades

A soft fork is like tightening the rules without kicking anyone off the road. Nodes that haven’t upgraded can still see and validate new blocks-but only if they follow the stricter rules. Older nodes might not understand the new rules, but they’ll still accept blocks made under them, as long as those blocks follow the old rules too. Bitcoin’s SegWit upgrade in 2017 was a soft fork. It changed how transaction data was stored to free up space. Miners who upgraded could include more transactions per block. Those who didn’t? They kept mining, but their blocks were smaller. The chain stayed one. No split. No new coin. Soft forks are quiet. They don’t create chaos. But they require enough miners or validators to adopt the new rules quickly. If too many stay on the old version, the upgrade fails.Hard Forks: The Great Divide

Hard forks are the dramatic ones. They break backward compatibility. Nodes that don’t upgrade become obsolete. They can’t read the new blocks. And if they keep trying to mine or validate, they’re building on a chain no one else accepts. This creates two separate blockchains. One keeps the old rules. The other runs the new ones. And here’s the kicker: both chains have the same history up to the fork block. After that? Different paths. Bitcoin Cash is the most famous example. In 2017, a group of developers and miners wanted bigger blocks to handle more transactions. The core Bitcoin team disagreed. So they forked. Bitcoin Cash was born. Same history as Bitcoin up to block 478558. After that? New rules. New coin. New community. Hard forks often create new cryptocurrencies. If you held Bitcoin before the fork, you got Bitcoin Cash for free. Same with Ethereum and Ethereum Classic after the DAO hack in 2016. One chain reversed the hack. The other kept it-believing in immutability above all.How a Fork Actually Happens

It doesn’t happen overnight. Here’s the real process:- Proposal: Someone suggests a change-maybe a new feature, a bug fix, or a philosophical shift. This gets written up as a formal proposal, like a BIP (Bitcoin Improvement Proposal) or EIP (Ethereum Improvement Proposal).

- Debate: Developers, miners, exchanges, and users argue. Reddit threads explode. Twitter threads go viral. Telegram groups split. Some want speed. Others want security. Some care about decentralization. Others just want lower fees.

- Consensus: If enough people agree, the change gets coded. Testnets are used. Nodes are updated. Wallets are prepared. Exchanges announce they’ll support the fork.

- Activation: At a pre-decided block number, the new rules go live. Nodes that upgraded switch over. Nodes that didn’t? They’re now on a dead chain.

- Split: Two chains exist. One has more hash power (or stake, in proof-of-stake). That becomes the main chain. The other might die… or live on as a niche project.

Why Do Forks Happen?

Forks aren’t random. They’re driven by real tensions:- Scalability: Bitcoin’s 1MB block limit led to high fees and slow confirmations. That’s why Bitcoin Cash and Bitcoin SV were born.

- Philosophy: Some believe blockchain should be immutable-no reversing transactions, even for hacks. Others believe ethics matter more than code. The DAO fork split Ethereum over this.

- Control: If a small group of developers holds too much power, others will fork to take back control. That’s how many altcoins started.

- Money: Forks can create new assets. If you hold the original coin, you get the new one for free. That’s a powerful incentive.

What Happens to Your Coins?

If you hold cryptocurrency in a wallet you control-like a hardware wallet or a non-custodial app-you automatically get the new coins after a hard fork. No action needed. The blockchain doesn’t care who owns what. It just follows the rules. But if your coins are on an exchange? That’s different. Exchanges decide whether to support the fork. Some credit you automatically. Others don’t. Some even freeze withdrawals during a fork to avoid chaos. In 2020, Bitcoin SV forked again. Many exchanges didn’t support it. If you held Bitcoin on Coinbase, you didn’t get Bitcoin SV. If you held it on Binance, you did. It’s not about the blockchain-it’s about the platform.

Who Wins? Who Loses?

Not every fork survives. Most die quietly. The new chain has no hash power. No users. No exchanges. It’s just a ghost ledger. The winners? The chains with the most support. Developers. Miners. Users. Exchanges. The one with the strongest community and economic incentives becomes the main chain. The losers? Everyone who held onto the dead chain. Their coins become worthless. Or, worse-they’re stuck with a coin no one accepts, no wallet supports, and no one trades. Ethereum Classic is still alive, but it’s a shadow of Ethereum. Bitcoin SV has a fraction of Bitcoin’s market cap. And dozens of other forks? Gone.The Future of Forks

Forks aren’t disappearing. But they’re changing. Proof-of-stake blockchains like Ethereum 2.0 make forks less disruptive. Validators vote on upgrades instead of miners competing for blocks. Governance tokens let holders vote on changes. That means fewer hard forks-because decisions are made before they become crises. Layer 2 solutions like Lightning Network and Optimism handle scaling without touching the base chain. That reduces the pressure to fork for performance. But the core truth remains: blockchain forks are how decentralized systems evolve. No one owns them. No one controls them. And when people disagree? The code splits. The chain divides. And the community chooses. It’s messy. It’s loud. It’s unpredictable. But it’s the only way a system without leaders can grow.What to Watch For

If you hold crypto, pay attention to:- Upcoming proposal deadlines (check GitHub or the project’s official forum)

- Whether your exchange will support the fork

- Who’s backing the new chain-developers, miners, or just speculators?

- Whether the fork solves a real problem-or just creates a new coin

What’s the difference between a soft fork and a hard fork?

A soft fork is a backward-compatible upgrade. Nodes that don’t update can still validate the new chain. A hard fork breaks compatibility. Nodes that don’t upgrade get left behind, creating two separate blockchains. Soft forks are quiet upgrades. Hard forks are splits.

Do I automatically get new coins after a hard fork?

If you control your private keys-like in a hardware or non-custodial wallet-yes. You’ll have the same balance on both chains after the fork. If your coins are on an exchange, it depends on whether the exchange supports the new chain. Some do. Some don’t. Always check before a fork.

Can a blockchain fork more than once?

Yes. Bitcoin has forked over 100 times. Most created minor or dead chains. Bitcoin Cash and Bitcoin SV are the only ones that stuck around with real usage. Ethereum forked to create Ethereum Classic. Forks can happen again if the community disagrees again.

Are blockchain forks safe?

Technically, yes-if the code is well-tested. But the real risk is community and economic. A fork can split a network, crash prices, or create scams. Always research who’s behind the fork and whether it solves a real problem. Don’t assume a new coin is valuable just because it exists.

Why do developers create forks instead of just updating the main chain?

Because there’s no central authority. In a decentralized network, every node must agree to change the rules. If a large group disagrees, they can’t be forced to upgrade. Forking is the only way to let dissenters leave without breaking the network for everyone else.

Naman Modi

December 19, 2025 AT 15:37Hard fork? More like hard split.

Still got my BTC. No worries.

Earlene Dollie

December 21, 2025 AT 02:14One group wants speed, another wants purity.

We’re basically a dysfunctional family with wallets.

And yet… we keep showing up.

Like it’s a cult. Or therapy. Or both.

I cried when Bitcoin Cash dropped. Not because I made money.

Because I felt seen.

Dusty Rogers

December 21, 2025 AT 09:03Most people don’t even notice when they happen.

But they’re the reason Bitcoin still runs after 15 years.

Don’t sleep on the quiet upgrades.

Kevin Karpiak

December 21, 2025 AT 15:24These forks? They’re just proof we don’t need Europe’s rules.

Let them have their ECB.

We got blockchain sovereignty.

Sophia Wade

December 23, 2025 AT 04:37Soft forks impose order without rupture.

Hard forks embrace chaos as a form of democratic expression.

It’s not about code - it’s about epistemology.

What do we believe is real when consensus fractures?

And who, ultimately, gets to define truth in a system without a pope?

Aaron Heaps

December 24, 2025 AT 20:55Bitcoin Cash? A speculator’s fantasy.

Ethereum Classic? A graveyard with a Twitter account.

Don’t confuse novelty with value.

98% of forks die. The rest? They’re just distractions.

Tristan Bertles

December 26, 2025 AT 08:11Went through the BCH split, the SV drama, even the ETH/ETC mess.

Didn’t panic. Didn’t trade.

Just watched.

Turns out the chain with the most devs, the most users, and the least hype? That’s the one that lasts.

Keep calm and HODL the consensus.

Megan O'Brien

December 26, 2025 AT 20:07Rollups, sidechains, state channels - all of it.

Why hard fork for scalability when you can just scale on top?

Base layer should stay minimal.

That’s the real thesis now.

Mmathapelo Ndlovu

December 27, 2025 AT 05:37People split over values, not just code.

Some want freedom, others want safety.

Some want speed, others want permanence.

And yet… we’re all just trying to build something better.

Maybe we don’t need to agree.

Maybe we just need to coexist 🌍❤️

Tyler Porter

December 28, 2025 AT 19:59Exchanges control your coins.

They decide if you get new coins after a fork.

That’s not decentralization.

That’s banking with a blockchain label.

Get a wallet. Seriously.

Rishav Ranjan

December 29, 2025 AT 19:44Steve B

December 29, 2025 AT 20:48Real power resides in the core development teams, mining pools, and institutional stakeholders.

Forks are performative dissent - orchestrated, not emergent.

The illusion of choice is the most effective control mechanism of all.

Grace Simmons

December 31, 2025 AT 09:04Bitcoin is backed by code and consensus.

When a fork happens, it’s not a failure - it’s a feature.

It proves the system can evolve without central authority.

That’s not chaos.

That’s resilience.

Collin Crawford

January 1, 2026 AT 15:30True consensus requires 100% agreement - which is impossible in a decentralized system.

Therefore, forks are not deviations - they are the logical endpoint of a system designed for non-coercive evolution.

Any claim that forks are 'messy' is a failure to comprehend the mathematical elegance of permissionless disagreement.

Jayakanth Kesan

January 3, 2026 AT 03:03But hey - at least you got free coins.

And the memes. Always the memes.

Amit Kumar

January 4, 2026 AT 08:54We don’t wait for consensus.

We just install the new app, ignore the popup, and keep scrolling.

Same with crypto forks.

Some people care about the tech.

Most of us just want to send money cheap and fast.

Bitcoin Cash? I used it once. Now I use USDT on TRC20.

Problem solved.

chris yusunas

January 6, 2026 AT 02:55Some want speed, some want sacred ledger, some just want free money

And honestly? That’s the whole point.

No boss. No CEO. No ‘you have to do it this way’

Just code, chaos, and a bunch of people yelling into the void

And somehow… it works