What is Base@FarCon 2025 (BASEFARCON) crypto coin?

Feb, 3 2026

Feb, 3 2026

Base@FarCon 2025, or BASEFARCON, isn’t a cryptocurrency built to change the world. It wasn’t created to solve a problem, improve payments, or power decentralized apps. It was launched as a marketing stunt - a fleeting moment wrapped in code, meant to spark attention, not value.

A token born from controversy

BASEFARCON dropped on May 20, 2025, right after Base - Coinbase’s Ethereum Layer 2 network - ran a campaign called "Base is for everyone." That campaign had its own token, which was gaining real traction. Then, without warning, Base rolled out BASEFARCON. The community felt blindsided. Within hours, the original "Base is for everyone" token crashed 99%. People called it a betrayal. The backlash was loud, fast, and ugly.

BASEFARCON isn’t traded like normal crypto. It’s listed on exchanges like Coinbase, Binance, and Poloniex, but here’s the odd part: those same exchanges say zero tokens are in circulation. Yet CoinMarketCap claims over 96,500 wallets hold it. How? Most of those wallets are likely just sitting on the tokens, never trading. No volume. No activity. Just holding.

Technical details: A token designed to discourage trading

BASEFARCON runs on the Base blockchain, using the ERC-20 standard. Its contract address is 0x6977...60A0d4. That’s public. But the real story is in its rules.

Every time someone buys, sells, or transfers BASEFARCON, a 20% tax is slapped on the transaction. That’s not a fee. That’s a wall. If you buy $100 worth, $20 vanishes before you even get the tokens. If you try to sell, another $20 gets taken. That’s why trading volume is consistently reported as $0 across all major platforms. No one wants to pay 20% just to move a token that’s already lost 87% of its value since launch.

The price peaked at $0.0001511 on day one. By December 2025, it was trading around $0.000017. That’s not volatility - that’s a collapse. Market cap? Just $19,390. For context, a single popular meme coin like DOGE has a market cap in the billions. BASEFARCON is a speck.

Who owns it? The concentration problem

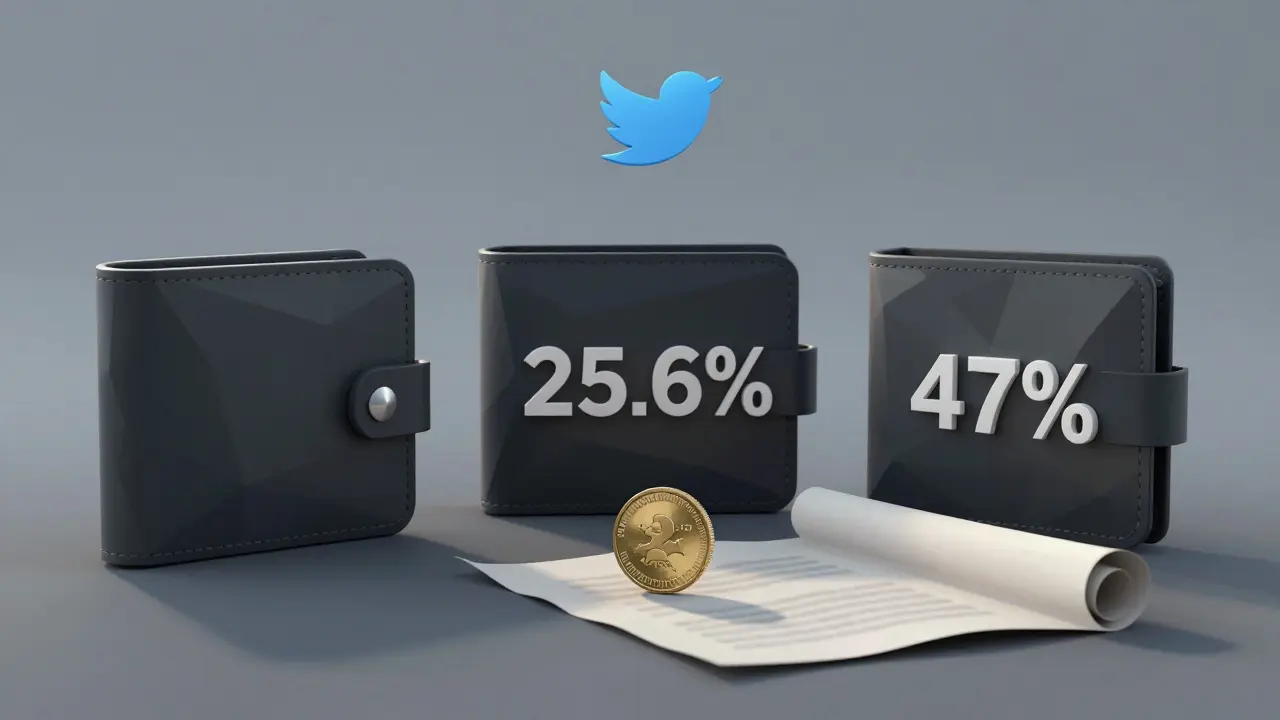

Ownership is terrifyingly centralized. According to MEXC’s analysis, the top three wallets control 47% of all BASEFARCON tokens. One single wallet holds 25.6%. That’s not decentralization. That’s a handful of people holding the keys to a coin nobody wants to trade.

This setup raises red flags. With so much supply in so few hands, those wallets could dump their tokens at any time and crash the price further. Or worse - they could manipulate the market by creating fake trades to make it look active. No one’s doing that either. The lack of volume suggests even the big holders are afraid to move.

Is it a meme coin? A content coin? Or just a scam?

Base’s lead developer, NKECHI, tried to reframe it. On Twitter, they called BASEFARCON a "content coin," not a meme coin. "What you buy is not a project, but a moment, an atmosphere, and a culture," they said. It sounds poetic. But poetry doesn’t pay bills.

Real crypto projects have roadmaps, teams, utilities, and users. BASEFARCON has none. No updates since launch. No new features. No partnerships. No developer activity. Just a website - farcontokenoff.xyz - with a whitepaper you can’t access and no way to contact anyone behind it.

It’s not a scam in the traditional sense. No one promised returns. No one ran a pump-and-dump scheme. But it’s a textbook example of a marketing experiment gone wrong. Base used Zora - a platform for NFTs and on-chain art - to mint the token. Zora’s revenue spiked to $137,000 in a single day from the chaos. Base got headlines. Zora got cash. The community got burned.

Why does it even exist?

Base’s goal wasn’t to build a currency. It was to test how far it could push the boundaries of "on-chain culture." They wanted to see if people would buy a token just because it was tied to an event, even if it had no function. The answer? A few thousand people bought it. Most didn’t trade it. The rest ignored it.

Compare it to other tokens on Base. The native BASE token has billions in trading volume. Projects like Kelp DAO, Frax, and Degen have real users and utilities. BASEFARCON is a ghost town in a bustling city.

Should you buy it?

Here’s the truth: if you’re thinking of buying BASEFARCON, you’re not investing. You’re gambling on a joke.

There’s no upside. The 20% tax makes any trade a loss. The price is stuck in a death spiral. The holders aren’t active. The team isn’t talking. The exchanges aren’t promoting it. Even Coinranking, which lists over 50,000 cryptocurrencies, gives it a ranking of #51,802 - and explicitly warns users it’s unverified and risky.

Some people bought it as a curiosity. Others as a protest. A few thought it might rebound. None of those reasons are sound investment strategies. If you already own it, you’re holding a digital artifact of a failed experiment. If you don’t, there’s no reason to start.

The bigger lesson

BASEFARCON isn’t about the token. It’s about what happens when big companies treat crypto like a viral TikTok trend. They think hype = value. They think launching a token = building a community. They’re wrong.

Real crypto grows through utility, transparency, and trust. BASEFARCON had none of that. It was a flash in the pan - a moment of noise, not innovation. And like most noise, it faded.

If you want to understand crypto, don’t look at BASEFARCON. Look at what happened after it launched. Base’s main ecosystem kept growing. Zora’s revenue dropped back to normal. The community moved on. The token? It’s still there - sitting in wallets, collecting dust, quietly proving that not everything with a blockchain behind it is worth owning.

Is BASEFARCON a real cryptocurrency?

Yes, technically. It’s a token on the Base blockchain with a contract address, supply, and listings. But it lacks the core traits of a functional cryptocurrency: trading volume, utility, active development, or community-driven growth. It’s more of a digital artifact than a currency.

Can I trade BASEFARCON for profit?

It’s nearly impossible. The 20% transaction tax means every trade loses value immediately. With near-zero volume, there’s no liquidity - you won’t find buyers or sellers at any reasonable price. Even if the price rises slightly, you’d still lose money after fees. Most holders are just sitting on it.

Why does CoinMarketCap show 96,500 holders if no one is trading?

The 96,500 holders are wallets that received the token during launch or via transfers. But holding ≠ trading. Many of these are likely inactive, abandoned, or held by bots. The fact that exchanges report zero circulating supply confirms that no meaningful trading is happening. It’s a disconnect between ownership data and actual market activity.

Is BASEFARCON related to Coinbase?

Yes, indirectly. BASEFARCON was launched by Base, which is owned by Coinbase. It was part of a marketing push tied to FarCon 2025. But Coinbase itself didn’t promote it as an investment. They framed it as a "content coin" - a cultural experiment. The company has since moved on and doesn’t reference it in official communications.

Can I use BASEFARCON to buy anything?

No. There are no merchants, platforms, or services that accept BASEFARCON as payment. It has zero utility outside of speculative holding. Even within the Base ecosystem, it’s ignored. It doesn’t pay for gas, access to apps, or NFTs.

Is BASEFARCON a scam?

It’s not a classic scam like a rug pull, where devs vanish with funds. No one stole money. But it’s a manipulative marketing tactic disguised as a crypto project. It exploited community trust, created artificial hype, and left holders with a worthless asset. Many experts consider it a cautionary example of how not to launch a token.

Will BASEFARCON ever recover?

Extremely unlikely. There’s no roadmap, no team activity, no community demand, and no incentive to trade. The 20% tax alone makes recovery impossible without a complete overhaul - which isn’t happening. It’s effectively dead as a functional asset. Its only legacy is as a case study in poor crypto marketing.