What is Safe (SAFE) crypto coin? Explained and How to Verify Its Credibility

Jul, 17 2025

Jul, 17 2025

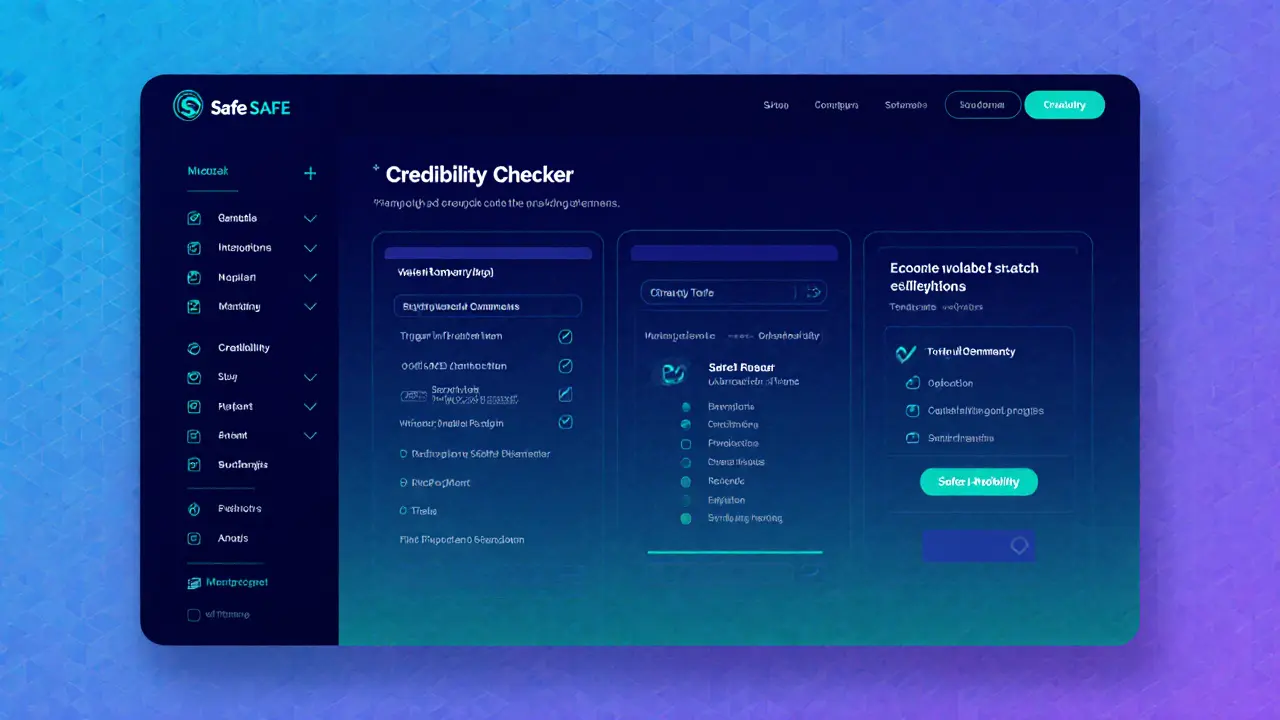

Safe (SAFE) Token Credibility Checker

Use this checklist to assess the credibility of the Safe (SAFE) token. Each criterion contributes to overall trustworthiness.

Enter details above and click "Evaluate Credibility" to see assessment results.

When you stumble upon a new digital asset called Safe SAFE a cryptocurrency that claims to offer a secure, low‑fee ecosystem for decentralized finance (DeFi) users, the first question is usually: "Is this legit, or just another copy‑cat scheme?" The crypto world is packed with promising projects, but also with countless scams. This guide breaks down what you need to know about the Safe crypto coin, how to find reliable data, and which red flags to watch for before you risk any money.

Key Takeaways

- Safe (SAFE) is a relatively unknown token; official sources are scarce.

- Always start with the project’s whitepaper, code repository, and blockchain explorer.

- Check token standards, market data, and community activity before investing.

- Use reputable wallets and exchanges that support the token’s blockchain.

- Apply a safety checklist to spot common scam patterns.

Why an Unknown Token Needs Extra Scrutiny

Cryptocurrencies are built on blockchain a distributed ledger that records every transaction in a transparent, immutable way. While the technology is trustworthy, the projects that launch on top of it can vary wildly. An unknown token may lack:

- Verified team members with public profiles.

- A audited smart‑contract codebase.

- Liquidity on reputable exchange a platform where users can buy, sell, or trade digital assets.

- Independent market data such as market cap the total value of all circulating tokens, calculated by price × supply.

If these fundamentals are missing, the risk of loss spikes dramatically.

How to Research Safe (SAFE) Properly

Start with the basics and move toward deeper technical checks.

- Official website and whitepaper: Look for a clear URL, a downloadable PDF, and a roadmap that explains the problem the token solves.

- Team and advisors: Real names, LinkedIn profiles, or past projects add credibility. Anonymous teams are not a deal‑breaker, but they need strong technical proof.

- Smart‑contract audit: Reputable firms like Certik, Quantstamp, or OpenZeppelin publish audit reports. Without an audit, treat the code as untrusted.

- Blockchain explorer: Identify the token’s contract address on a explorer such as Etherscan (if it’s an ERC‑20) or BscScan (for BEP‑20). Verify total supply, holders, and recent activity.

- Community presence: Active Telegram, Discord, Reddit, or Twitter channels with real‑time discussions are a good sign. Watch for bots or overly promotional language.

- Liquidity pools: Check if the token is listed on decentralized exchanges (DEXes) like Uniswap or PancakeSwap. Low liquidity means you could be stuck with tokens you can’t sell.

Red Flags Specific to Safe (SAFE)

Because public data on Safe is limited, the following warning signs deserve extra attention:

- No verifiable contract address: If you can’t locate a contract on a reputable explorer, the token may not exist on a public chain.

- Unclear token standard: Safe should state whether it follows ERC‑20, BEP‑20, or another standard. Ambiguity often masks poorly written code.

- Inflated promises: Claims like “guaranteed 10% daily returns” or “risk‑free yields” are classic scam lures.

- Missing audit: No third‑party security audit means the smart contract could have hidden backdoors.

- Zero or fake market data: If CoinGecko, CoinMarketCap, or Messari show no listing or only a placeholder, treat the token cautiously.

Where to Find Reliable Information

Even when a token is obscure, these sources can still provide useful insight:

| Source | What It Offers | Reliability Rating |

|---|---|---|

| Official Website | Whitepaper, roadmap, team bios | High |

| Blockchain Explorer | Contract address, holder distribution, transaction history | High |

| Audit Report | Security analysis, vulnerability list | Medium‑High |

| Community Channels | Live Q&A, developer updates | Variable |

| Market Data Aggregators | Price, volume, market cap | Medium |

How to Store and Trade Safe (SAFE) Safely

If you decide the token passes your due‑diligence, you’ll need a wallet software or hardware that holds private keys and lets you interact with the blockchain that supports its underlying standard. Common options include:

- MetaMask - works with ERC‑20 tokens on Ethereum and compatible chains.

- Trust Wallet - mobile‑first, supports BEP‑20 and many other standards.

- Hardware wallets like Ledger or Trezor - best for long‑term storage.

To trade, look for listings on reputable DEXes that match the token’s blockchain. If an exchange requires you to deposit via a third‑party “bridge” that isn’t officially documented, walk away.

Safety Checklist Before Buying Any New Token

- Confirm the contract address on an official explorer.

- Verify the token standard (ERC‑20, BEP‑20, etc.).

- Read the whitepaper - does it explain a real problem?

- Check for an independent security audit.

- Assess liquidity - can you sell at market price?

- Research the team - are their identities public?

- Join community channels - are moderators responsive?

- Start with a tiny amount - test withdrawals and swaps.

Cross off each item; if you’re missing more than two, reconsider the investment.

Frequently Asked Questions

What blockchain does Safe (SAFE) run on?

Public information is scarce, but most projects using the ticker SAFE launch as an ERC‑20 token on Ethereum. Verify the contract address on Etherscan to be sure.

Is there an official audit for Safe?

As of October2025, no reputable audit firm has published a report for Safe. Absence of an audit is a red flag and should weigh heavily in your decision.

Where can I buy Safe (SAFE)?

If the token is listed, it will appear on decentralized exchanges like Uniswap (for ERC‑20) or PancakeSwap (for BEP‑20). Always double‑check the contract address before swapping.

How do I store Safe safely?

Use a non‑custodial wallet that supports the token’s standard. MetaMask for Ethereum‑based tokens or Trust Wallet for Binance Smart Chain are common choices. For large holdings, move to a hardware wallet.

What are common scams to watch for with new tokens?

Pump‑and‑dump schemes, fake audit certificates, misleading “guaranteed returns”, and phishing sites that mimic the official website are the most frequent tactics. Always verify URLs and cross‑reference information.

Bottom Line

Safe (SAFE) remains a low‑profile token with limited publicly verified data. That doesn't automatically make it a scam, but the lack of clear documentation, audit, and market presence means you should proceed with maximum caution. Follow the research steps, apply the safety checklist, and never invest more than you can afford to lose. In the fast‑moving crypto space, due diligence is the only reliable guard against losing your hard‑earned money.

Lara Cocchetti

July 17, 2025 AT 19:35Look, the crypto world isn’t the utopia some would have you believe; there are shadowy cabals keen on hiding their true motives. Safe (SAFE) appears to be another pawn in a larger scheme to funnel unsuspecting users into a controlled ecosystem. The lack of transparent leadership feels like a deliberate veil, protecting those who profit from the chaos. Morally, we cannot turn a blind eye to projects that operate in this murky twilight. If you value integrity, demand verifiable proof before even considering a token that whispers more than it shouts.

Mark Briggs

July 27, 2025 AT 01:49Safe? More like a scam wrapped in a meme.

mannu kumar rajpoot

August 5, 2025 AT 08:02Scrolling through the SAFE token details feels like wandering a maze with no exit signs; the information is scattered and vague. One could argue that anonymity is a hallmark of decentralization, yet here it becomes a smokescreen. The community chatter is louder than any substantive roadmap, which only deepens the suspicion. In my view, the project teeters on the edge of credibility.

Tilly Fluf

August 14, 2025 AT 14:15It is commendable that this guide emphasizes diligent research before investing. The checklist provided offers a clear pathway for newcomers to assess token legitimacy. By encouraging verification of contract addresses and audits, the article upholds best practices. I hope more readers adopt this cautious approach.

Darren R.

August 23, 2025 AT 20:29When I peruse the labyrinthine world of obscure tokens, I cannot help but sense the invisible hands that pull the strings behind the curtain. The Safe (SAFE) coin, with its scant documentation, reeks of a project that perhaps wishes to evade the bright scrutiny of the mainstream. One must ask: who are the architects of this venture, and why do they cloak their identities in digital fog? In the age of transparency, anonymity is often a red flag, not a badge of honor! The absence of an audit by a reputable firm is tantamount to leaving your house unlocked while shouting, 'Come steal whatever you like!' Liquidity, the lifeblood of any token, appears to be as thin as a whisper on a cold night, making exit strategies into a perilous gamble. Should you attempt to trade on a decentralized exchange, you may discover that the slippage is so severe that your modest investment evaporates like morning dew. The whitepaper, if it exists, is either buried beneath layers of SEO‑laden marketing fluff or is a ghostly PDF that vanishes upon download. Even the contract address, a beacon for verification, is shrouded in ambiguity, leaving even seasoned analysts scratching their heads. Moreover, the token’s claim of "secure, low‑fee ecosystem" sounds suspiciously like a lullaby sung to drowsy investors. History teaches us that promises of guaranteed returns are the siren songs that have led countless sailors to the rocks of financial ruin. Thus, exercising a healthy dose of skepticism is not merely advisable, it is essential for survival. If you are compelled to allocate any capital, do so only after performing a forensic audit of the smart contract code yourself. Open‑source tools such as MythX or Slither can reveal hidden backdoors that the project creators would rather keep concealed. In short, treat Safe (SAFE) as a high‑risk speculative instrument, and never, under any circumstances, invest more than you can afford to lose!

Hardik Kanzariya

September 2, 2025 AT 02:42Your thorough breakdown really hits the nail on the head. For anyone teetering on the edge of curiosity, your warning is invaluable. Remember, starting with a minuscule amount can safeguard against unforeseen pitfalls.

Shanthan Jogavajjala

September 11, 2025 AT 08:55The SAFE token purportedly adheres to an ERC‑20 interface, yet the ABI signature remains undocumented in public repositories. Such opacity hampers interoperability with DeFi protocols that rely on standard calldata schemas. Additionally, gas optimization appears neglected, potentially inflating transaction costs for end‑users. A deeper audit of the bytecode would elucidate these concerns.

Millsaps Delaine

September 20, 2025 AT 15:09When one contemplates the labyrinthine intricacies of nascent crypto projects, the mind inevitably drifts toward the specter of concealed motives. Safe (SAFE) presents itself with a veneer of security, yet the foundations upon which it stands appear, upon closer inspection, to be built on shifting sands. The conspicuous absence of a verifiable whitepaper suggests a reluctance to subject the project's aspirations to scholarly critique. In the realm of decentralized finance, transparency is not merely a virtue but a prerequisite for any semblance of trust. Anonymity, while occasionally justified, in this context reads as an evasive maneuver designed to obfuscate accountability. The token's liquidity profile, as observed on major DEX aggregators, is lamentably thin, bordering on illiquid morass. Such scarcity amplifies slippage, rendering even modest trades a hazardous endeavor. Moreover, the claim of "low‑fee ecosystem" is rendered dubious when the underlying smart contract lacks thorough optimization. Audits, conducted by esteemed firms such as Certik or Quantstamp, have not been disclosed, leaving the code's integrity in question. One must also consider the psychological tactics employed: grandiose promises of guaranteed returns are classic lures for the uninformed. Historical precedent within the crypto sphere is replete with projects that masqueraded as revolutionary before collapsing under fraudulent weight. Consequently, the prudent investor should approach Safe with a healthy tincture of skepticism, treating it as a high‑risk speculative instrument. If curiosity persists, employing open‑source analysis tools like Slither or MythX can illuminate hidden vulnerabilities. These instruments serve as forensic microscopes, revealing backdoors that may otherwise remain concealed. In sum, the onus lies upon the individual to conduct rigorous due diligence before allocating capital. Do not allow the siren song of easy profit to override your responsibility to safeguard your assets.

Jack Fans

September 29, 2025 AT 21:22Great point, sir!-indeed, due‑diligence is the keystone; however, let me add that even with tools like slither, one must cross‑verify findings-otherwise, you might miss a subtle re‑entrancy-yes, that's true, but watch out for typos in contract names-always double‑check!

Adetoyese Oluyomi-Deji Olugunna

October 9, 2025 AT 03:35The discourse surrounding Safe is, shall we say, profoundly underwhelming; a more rigorous scholarly approach is warranted.

Krithika Natarajan

October 18, 2025 AT 09:49Agreed-checking the contract on Etherscan first is essential.

Ayaz Mudarris

October 27, 2025 AT 15:02In the grand tapestry of financial innovation, each new token represents a thread that may either enrich or unravel the fabric. It is incumbent upon scholars and practitioners alike to apply a methodical lens, scrutinizing provenance, governance, and technical robustness. By doing so, we preserve the integrity of the decentralized ecosystem. Moreover, rational assessment supersedes emotive speculation, ensuring sustainability. Let us, therefore, champion evidence‑based evaluation.

Irene Tien MD MSc

November 5, 2025 AT 21:15Oh, absolutely, dear Ayaz, your eloquent musings about the 'tapestry' and 'threads' are as soothing as a cotton‑candy cloud drifting over a volcano of hype! While you advocate for a 'methodical lens,' the reality is that many venture into the cryptoverse with the subtlety of a fireworks display in a library. The so‑called 'rational assessment' often gets drowned out by flamboyant promises of moon‑landing yields and rainbow‑colored returns. One must wonder whether these poetic proclamations mask the very same old scams dressed in fresh metaphors. Nevertheless, your call for evidence‑based evaluation is a beacon-if only it could cut through the neon‑lit fog that engulfs projects like Safe.

kishan kumar

November 15, 2025 AT 03:29Contemplating the ontology of a token such as Safe invites us to examine the dialectic between perceived value and ontological existence; does a coin truly possess worth absent a consensus of belief? In this epistemic landscape, the absence of a verifiable audit functions as an ontological void, a black hole of uncertainty. Therefore, the prudent scholar must apply both rigorous analytical methods and a measure of philosophical skepticism. Let us, as custodians of reason, refrain from uncritical capitulation-knowledge is our shield. :)

Anthony R

November 24, 2025 AT 09:42Indeed, your philosophical framing is most enlightening-however, one must also consider practical aspects, such as market depth and community engagement; these tangible metrics complement the abstract discourse!

Vaishnavi Singh

December 3, 2025 AT 15:55The interplay of theory and practice in token evaluation is subtle; while philosophy guides, data grounds. A balanced approach yields clearer insight.

Linda Welch

December 12, 2025 AT 22:09Look, if we keep letting foreign‑run shady tokens flood our markets, America’s financial sovereignty will be nothing but a meme, safe token is just another example of a foreign plot to drain our wallets, we should protect our investors and keep crypto home‑grown, stop worshipping anonymous projects that hide behind ‘decentralized’ buzzwords, our economy deserves better than these fly‑by‑night schemes, any token without a clear US regulatory path is a risk we cannot afford.

Kevin Fellows

December 17, 2025 AT 18:35Totally get your frustration, but let’s keep the convo chill-just do your own research and decide what feels right for you!