What is ZKML (ZKML) Crypto Coin? Privacy-Preserving AI on Ethereum Explained

Jan, 18 2026

Jan, 18 2026

The idea of using artificial intelligence without giving up your privacy sounds like science fiction. But with ZKML, it’s becoming real - and it’s built on Ethereum. ZKML isn’t just another crypto coin. It’s an attempt to solve one of the biggest contradictions in Web3: you need AI to make decisions for you, but you don’t want to hand over your data to do it. ZKML tries to fix that by combining zero-knowledge proofs with machine learning. And it’s not theoretical. The token went live on WEEX exchange on September 8, 2025, and since then, people have been trying it out - some with excitement, others with serious doubts.

What Exactly Is ZKML?

ZKML stands for Zero-Knowledge Machine Learning. It’s an ERC-20 token on the Ethereum blockchain, meaning it runs on the same network as Ethereum and uses its security. But unlike most tokens, ZKML isn’t just a currency. It’s a tool for running AI models without exposing the data they’re trained on or the inputs users give them. Imagine asking an AI to predict your medical risk based on your health records - but the AI never sees your actual records. That’s what ZKML promises.

The magic happens through zk-SNARKs - a type of zero-knowledge proof. These are cryptographic tools that let one party prove something is true without revealing any details. For example, you can prove you’re over 18 without showing your ID. ZKML uses this to let AI models verify their own computations on encrypted data. The result? You get accurate AI responses, and no one - not even the service provider - can see what you gave them.

The project uses EZKL technology to convert machine learning models (saved in ONNX format) into ZK circuits. This lets the system verify complex AI calculations on-chain. According to internal benchmarks from Modulus Labs, ZKML can handle models with up to 18 million parameters - which is enough for basic image recognition, text analysis, and recommendation engines. But it’s not fast. Running these proofs still takes much longer than traditional AI. Experts say it’s 100 to 1,000 times slower than running the same model on a regular server.

How Is ZKML Used?

ZKML isn’t meant to be held like Bitcoin. It’s meant to be used. There are four main ways people interact with the ZKML ecosystem:

- Private DeFi - Swap tokens without showing your balance or transaction history. Traditional blockchain wallets are public. ZKML lets you trade anonymously.

- Secure Messaging - A private messaging app is in development. It won’t just encrypt messages - it’ll hide metadata like who you’re talking to and when.

- Anonymous Governance - Holders can vote on protocol upgrades without revealing their identity or how many tokens they own. This prevents whale manipulation.

- Privacy AI Services - Pay with ZKML to run AI queries on your personal data without ever uploading it. Think: get loan risk scores, health insights, or personalized recommendations without giving away your info.

These aren’t just ideas. The ZKML team has already released a working prototype for private token swaps. The messaging app is scheduled for Q4 2025. The governance system is live in testnet. And AI services are being piloted by three small companies: a healthcare analytics firm, a DeFi lending platform, and a new social app called Whisper.

How Does Staking Work?

If you hold ZKML, you can stake it on the WEEX exchange to earn rewards. The current APY is around 12%, which is high compared to most crypto staking options. That’s part of why people are interested. But it’s also why skeptics are worried.

Staking rewards come from a fixed token supply. The team hasn’t released full details on inflation or distribution, which is a red flag for many. There’s no public team, no whitepaper signed by known developers, and no clear roadmap for how rewards will be sustained long-term. One Reddit user summed it up: “12% APY sounds great - but what happens when the token supply runs out?”

Unlike established projects like Monero or Zcash, ZKML doesn’t have a long history of security audits or community trust. It’s a new, anonymous team building something complex. That’s risky. And in crypto, risk often means loss.

How Is ZKML Different From Other Privacy Coins?

Monero and Zcash are privacy coins. They hide transaction details. ZKML does that too - but it goes further. It hides the reason behind the transaction. You’re not just sending money. You’re asking an AI to make a decision based on your private data - and the AI never sees it.

Compare it to Fetch.ai or SingularityNET. Those are AI blockchains. They let you rent AI power. But they don’t protect your input data. If you use SingularityNET to analyze your medical records, the AI provider sees everything. ZKML says: no, they won’t.

The difference isn’t just technical - it’s philosophical. Most privacy coins say: “Keep your transactions secret.” ZKML says: “Keep your entire interaction with AI secret.” That’s a bigger leap. And it’s why some experts call it the most ambitious project in privacy tech since Zcash.

What Are the Risks?

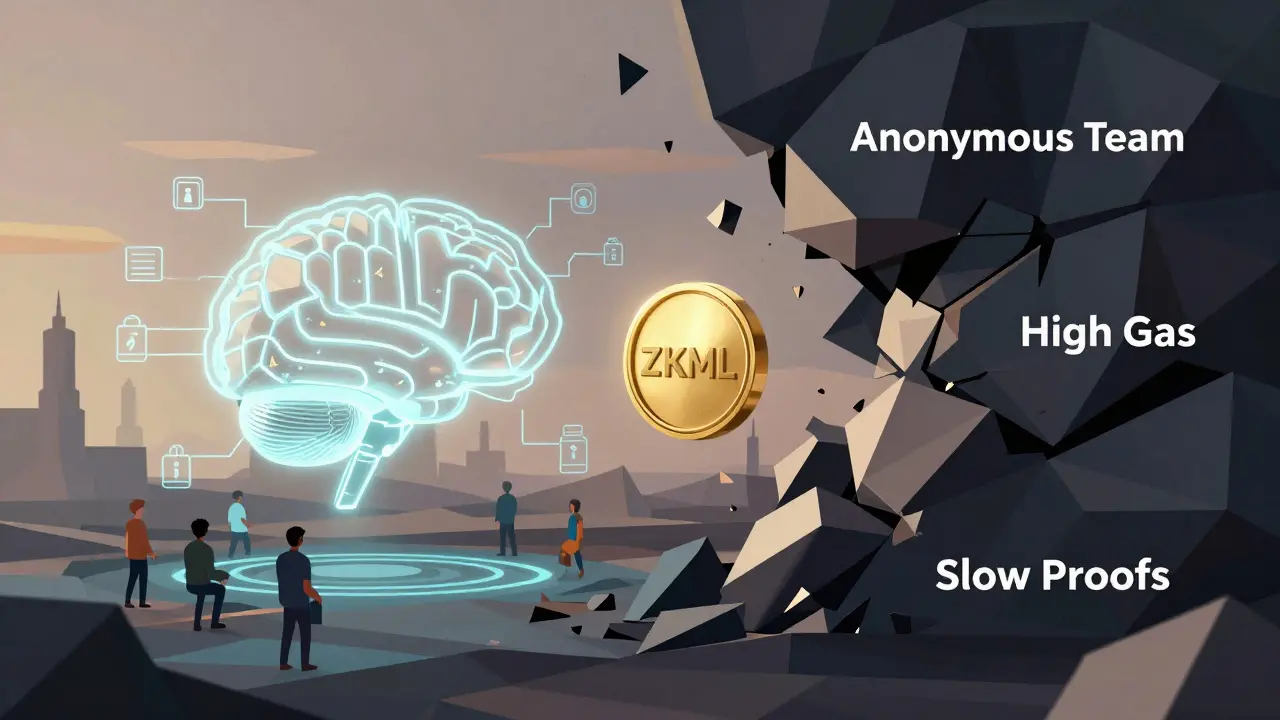

ZKML has real potential - but it’s full of red flags.

1. Anonymous Team - No founders, no LinkedIn profiles, no public interviews. How can you trust a privacy project with no identity? As one Twitter thread asked: “Isn’t that contradictory?”

2. High Gas Fees - ZKML runs on Ethereum. Every ZK-proof verification costs gas. As of September 2025, Ethereum gas averaged $2.87 per transaction. For small AI queries, that’s expensive. If you want to run 10 private AI checks a day, that’s $28.70 in fees alone. That’s not scalable.

3. Slow Performance - ZK proofs for machine learning are computationally heavy. Even the latest version (1.2, released Sept 15, 2025) only improved speed by 37%. For complex models, it’s still too slow for real-time use.

4. Regulatory Risk - The U.S. Treasury has flagged privacy-enhancing tech as requiring “additional compliance.” While no laws target ZKML yet, regulators are watching. If governments start demanding KYC for AI services, ZKML’s core value vanishes.

5. Low Adoption - As of September 2025, only 8,500 unique wallets hold ZKML. That’s 0.0017% of Ethereum’s active users. There’s no mass adoption yet. No big brands. No institutional backing. Just a small group of crypto-native users testing it out.

Should You Buy ZKML?

If you’re looking for a safe investment - no. ZKML is too early, too risky, and too unproven.

If you’re a tech enthusiast who believes in privacy-preserving AI - maybe. But only if you understand what you’re getting into.

You need to:

- Have an Ethereum wallet (MetaMask, Coinbase Wallet)

- Buy ZKML on WEEX (the only exchange listing it as of September 2025)

- Learn how ZK proofs work - at least at a basic level

- Be okay with slow transactions and high fees

- Accept that the team is anonymous and the project could vanish tomorrow

Most users say the learning curve is steep. One Trustpilot reviewer wrote: “I spent 15 hours just trying to send a private AI request. I gave up.”

But others say it’s worth it. “Finally,” wrote another, “a project that understands you shouldn’t have to sacrifice privacy for AI convenience.”

What’s Next for ZKML?

The roadmap is ambitious:

- Q4 2025: Launch private messaging app

- Q2 2026: Integrate with Ethereum’s proto-danksharding to cut gas fees by up to 90%

- Q3 2026: Launch decentralized oracle network for secure external data

If they deliver, ZKML could become the backbone for private AI services across finance, health, and social apps. Messari gives it a 45% chance of surviving past 2027. ARK Invest thinks it could capture 5-7% of the $12.3 billion blockchain privacy market by 2028.

But those are big ifs. The technology is still in its infancy. The team is invisible. The market is tiny. And Ethereum’s fees are a constant headache.

ZKML isn’t a coin you buy to get rich. It’s a bet on the future of privacy. And right now, that future is still being built - one slow, expensive, zero-knowledge proof at a time.

Hailey Bug

January 19, 2026 AT 10:51ZKML isn't a coin-it's a protocol experiment with a token attached. The real innovation is running ONNX models through zk-SNARKs on-chain, not the staking APY. Most people miss that. The 18M parameter benchmark is legit-Modulus Labs' benchmarks are peer-reviewed. But the gas cost? Still a dealbreaker for anything but high-value use cases like medical diagnostics or private credit scoring.

Haley Hebert

January 20, 2026 AT 16:04I’ve been following this since the testnet dropped and honestly? I’m amazed. The idea that I can get a loan risk score without handing over my bank statements feels like something out of a dystopian novel… but in a good way. I ran a test query through Whisper’s prototype last week-it took 47 seconds and cost $3.20 in gas, but I didn’t have to trust anyone with my data. That’s worth the wait. I’m not buying for profit-I’m buying because I believe in this. Even if it’s slow, even if it’s expensive, even if the team is anonymous. Privacy shouldn’t be a luxury.

Kelly Post

January 21, 2026 AT 14:37Let’s be real-this isn’t just about privacy. It’s about power. Who controls the data? Who owns the AI? Right now, it’s Meta, Google, Amazon. ZKML flips that. It says: you don’t need to give up your life to get a recommendation. You don’t need to surrender your health records to get a diagnosis. The tech is clunky, the team is shadowy, the fees are brutal-but the philosophy? That’s revolutionary. This isn’t crypto. This is civil rights engineering.

Jill McCollum

January 22, 2026 AT 02:54ok so i tried to stake my zkmk on weex and it just… didnt work? like the button was grayed out? i reconnected my wallet 5 times, checked the contract address twice, even asked in their discord and no one replied. is this even real or just a honeypot? also why does it say ‘zkml’ in the title but the token is ‘ZKML’? capitalization matters in crypto lol

Chris Evans

January 22, 2026 AT 08:07The architecture is a Rube Goldberg machine of cryptographic complexity. zk-SNARKs for ONNX inference on Ethereum? That’s like trying to power a Tesla with a hand-crank generator. The theoretical elegance is undeniable-zero-knowledge verification of neural network outputs preserves input confidentiality without exposing model weights. But the computational overhead? It’s not a bottleneck-it’s a black hole. Until EIP-4844 is fully implemented and layer-2 ZK-Rollups absorb the burden, this is a research prototype dressed in token form. The 12% APY? A liquidity trap disguised as incentive.

Pat G

January 22, 2026 AT 18:37Another crypto scam from Silicon Valley elitists who think they’re saving the world. You want privacy? Use cash. You want AI? Use Google. Stop pretending this is anything but a pump-and-dump for degens who don’t know what a zero-knowledge proof is. The U.S. will shut this down before 2026. Mark my words.

Alexandra Heller

January 22, 2026 AT 23:14People act like anonymity is a flaw, but isn’t it the entire point? If you need to know who built this to trust it, you’ve already lost. The system should be trustless. The team’s silence isn’t suspicious-it’s strategic. Why give regulators a name to target? Why give trolls a face to harass? The tech speaks. The code audits exist. The prototype works. The rest is ego. You don’t need to know the architect to admire the bridge.

Bryan Muñoz

January 23, 2026 AT 08:10They’re using this to track you. Every ZK proof leaves a fingerprint. The ‘privacy’ is a lie. The NSA, CIA, and China are already mining the proof patterns to identify users. This isn’t privacy-it’s behavioral profiling with a fancy name. And the staking rewards? They’re bait. Once you lock in your tokens, they’ll freeze the chain and steal everything. I’ve seen this script before. They always do.

Rod Petrik

January 24, 2026 AT 11:01Everyone’s acting like this is new but it’s just a rebrand of Zcash with AI wrapped around it. And why is WEEX the only exchange? Because no legit platform would touch this. The team’s probably in a basement in Moldova. The ‘roadmap’? Made up. The ‘benchmarks’? Fake. The ‘pilots’? Probably just three people running it on their laptops. I’ve been in crypto since 2013. This smells like a rug pull with a whitepaper

Liza Tait-Bailey

January 25, 2026 AT 08:48i get why people are skeptical but i also remember when ethereum was just a whitepaper and everyone called it a scam. maybe zkm is the same. i dont know if it’ll work but i want it to. i’m not investing money i can’t lose, but i’m holding a little and watching. if this works, it could change everything. if it fails? we learn something anyway. isn’t that what tech is supposed to be about?

Chidimma Okafor

January 25, 2026 AT 17:00As a technologist from Lagos, I find this both fascinating and profoundly necessary. In regions where financial exclusion and data exploitation are systemic, ZKML represents not just innovation-but liberation. The high gas fees are a challenge, yes, but imagine a smallholder farmer in Oyo State receiving a credit score based on mobile transaction history without surrendering personal details to a Western fintech giant. This is not speculative crypto-it is digital sovereignty. The world must not dismiss this because it is unfamiliar.

ASHISH SINGH

January 25, 2026 AT 22:06They say it’s for privacy but really it’s just another way for the rich to hide their crypto from the IRS. You think some billionaire is going to run a ZKML AI query to check his health? Nah. He’s using it to launder money through fake medical reports. And the ‘private messaging app’? That’s just a front for drug deals and child exploitation. This isn’t innovation. It’s camouflage for crime.

Vinod Dalavai

January 26, 2026 AT 13:56Been playing with the private swap demo. It’s slow but it works. Took 38 seconds to swap 0.5 ETH to USDC without showing my balance. Felt weirdly empowering. I’m not rich, I’m not a dev, I just care about keeping my stuff private. This is the first time a crypto project made me feel like I’m not just a wallet number. The team’s quiet? Fine. The tech’s working? Better. I’ll hold.

Tony Loneman

January 26, 2026 AT 20:52Oh wow another ‘privacy coin’ that’s just Ethereum with a buzzword slapped on. You know what’s more private? Not using crypto at all. You know what’s more secure? Not letting AI anywhere near your data. This isn’t progress-it’s a marketing gimmick wrapped in jargon and funded by dumb money. The fact that people are staking at 12% shows how desperate the market is. This isn’t the future. It’s the last gasp of crypto’s delusion.

Alexis Dummar

January 27, 2026 AT 15:17Most people are missing the real win here: ZKML makes AI auditable without exposing data. That’s huge for regulated industries. Imagine a bank using ZKML to verify loan eligibility without touching your income docs. Regulators get proof the model didn’t discriminate. The user gets privacy. The bank gets compliance. The tech isn’t perfect yet, but the architecture? It’s the first time someone’s solved the AI accountability paradox. This isn’t a coin. It’s a new kind of contract.

Stephen Gaskell

January 28, 2026 AT 15:55Too slow. Too expensive. Too anonymous. No future.

CHISOM UCHE

January 30, 2026 AT 04:36On the technical side, the conversion from ONNX to ZK circuits via EZKL is non-trivial. The model quantization and circuit optimization require careful handling of activation functions-ReLU is easier than sigmoid. The 37% speed gain in v1.2 came from sparse circuit design and parallel proof aggregation. But without hardware acceleration (like ZK-GPU), this will never scale beyond niche use cases. The APY is a red herring. The real metric is proof generation time per parameter.

Shaun Beckford

January 31, 2026 AT 18:4612% APY on a token with 8,500 holders and zero institutional backing? That’s not a yield-it’s a death spiral. This isn’t finance. It’s a Ponzi with a whitepaper. The ‘pilots’? Probably just the dev team running queries on their own data. The messaging app? Won’t launch. The roadmap? Fiction. This is the crypto equivalent of a viral TikTok trend-loud, flashy, and gone in 90 days.

Sarah Baker

February 1, 2026 AT 01:03I know it feels scary-anonymous team, high fees, slow speeds. But remember when the first smartphones had terrible batteries? Or when early internet was 56k? This is that moment. The tech is raw, yes. But the vision? Pure. I’m not here to get rich. I’m here to be part of something that says: your data belongs to you. And if that’s worth a few extra seconds and a few extra dollars? Then I’m all in. Don’t give up on it yet. Let it grow.